Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 150.99

Kijun-Sen- 150.82

Previous week high – 153.45

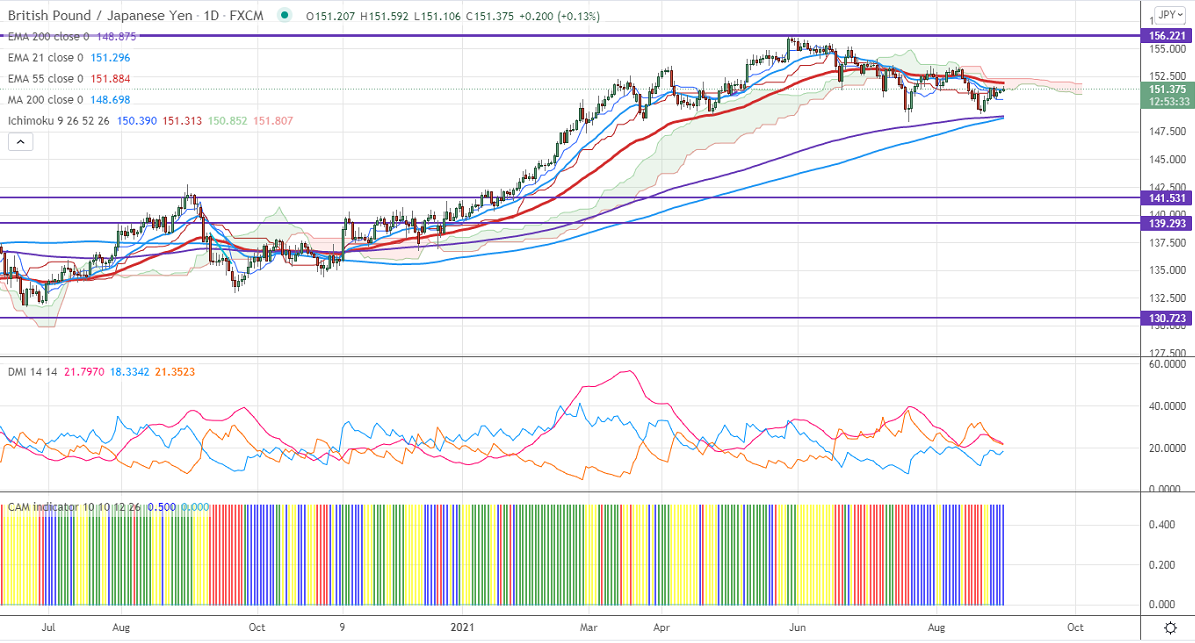

GBPJPY is consolidating in a narrow range between 150.94 and 151.59 for the past three days. It is holding above 151 levels on pound sterling bullishness. GBPUSD trades above 1.3750 on board-based US dollar weakness. Any breach above 1.380 confirms bullish continuation. The Brexit pessimism and spread of the delta variant are putting pressure on Pound. The intraday trend of GBPJPY is neutral as long as resistance 151.75 holds.

USDJPY- Analysis

The pair has once again declined after a breach above the 110 level. The intraday resistance to watch 110.25. Significant support is around 109.

Technical:

The pair's immediate resistance is around 151.75, any jump above targets 152/153. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 150.50. Any indicative violation below targets 150/149/148.45.

Ichimoku Analysis- The pair is trading above 4- hour Kijun-Sen and below Tenken-Sen

Indicator (4 Hour chart)

CAM indicator- Slightly Bullish

Directional movement index –Neutral

It is good to buy on dips around 150.55-60 with SL around 150 for a TP of 153.