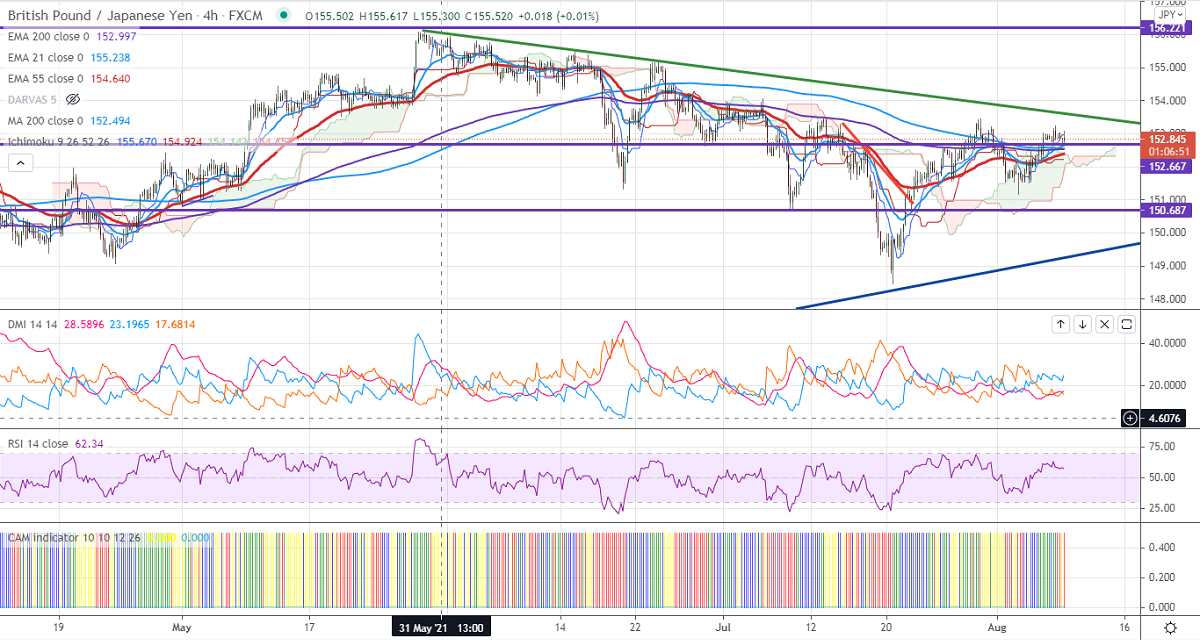

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.51

Kijun-Sen- 152.20

Previous week high – 153.45

GBPJPY is trading slightly lower after hitting a high of 153.24.The minor sell-off in Pound sterling due to Brexit pessimism. But the decline in the number of coronavirus cases and positive economic data is preventing further downside. USDJPY is holding above 110 levels amid a surge in US bond yields. Any breach above 110.60 confirms further bullishness. The intraday trend of GBPJPY is still bullish as long as support 152 holds.

Technical:

The pair's immediate resistance is around 153.25, any violation above targets 153.50/154/155.05/156. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 152.49. Any indicative violation below targets 152/151.54/151.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and above Tenken-Sen.

Indicator (4-Hour chart)

CAM indicator-Neutral

Directional movement index –Neutral

It is good to buy on dips around 152.50-55 with SL around 151.40 for a TP of 155.