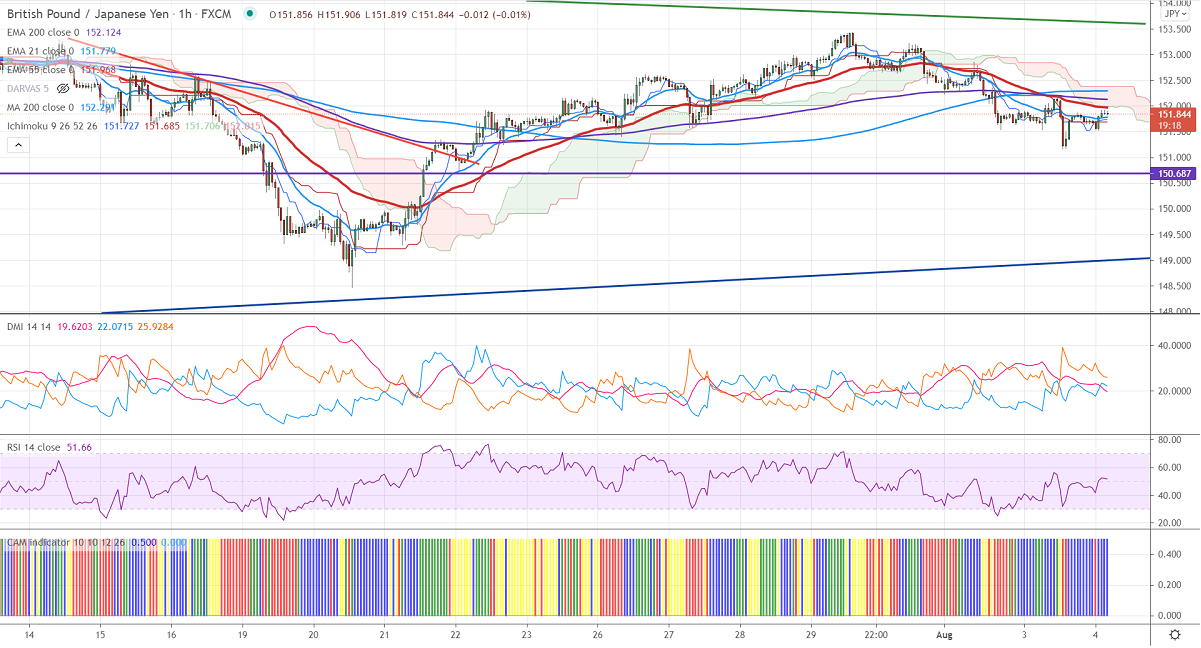

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 151.72

Kijun-Sen- 151.68

Previous week low – 148.45

GBPJPY has shown a minor pullback after hitting a low of 151.17. The slight recovery in the Pound sterling is supporting the pair at lower levels. The dip in coronavirus cases in Britain and soft US dollar lifting GBPUSD higher. The yen hits a multi-month high against the USD on increasing safe-haven demand. A breach below 109 confirms further bearishness.

Technical:

The pair's immediate resistance is around 152.25, any violation above targets 152.65/153/153.50. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 151.40. Any indicative violation below targets 150.60/150/149.

Ichimoku Analysis- The pair is trading above 1-hour Tenken-Sen and below Kijun-Sen.

Indicator (1-Hour chart)

CAM indicator- Slightly Bullish

Directional movement index –Neutral

It is good to sell on rallies around 152.50-55 with SL around 153.50 for a TP of 149.