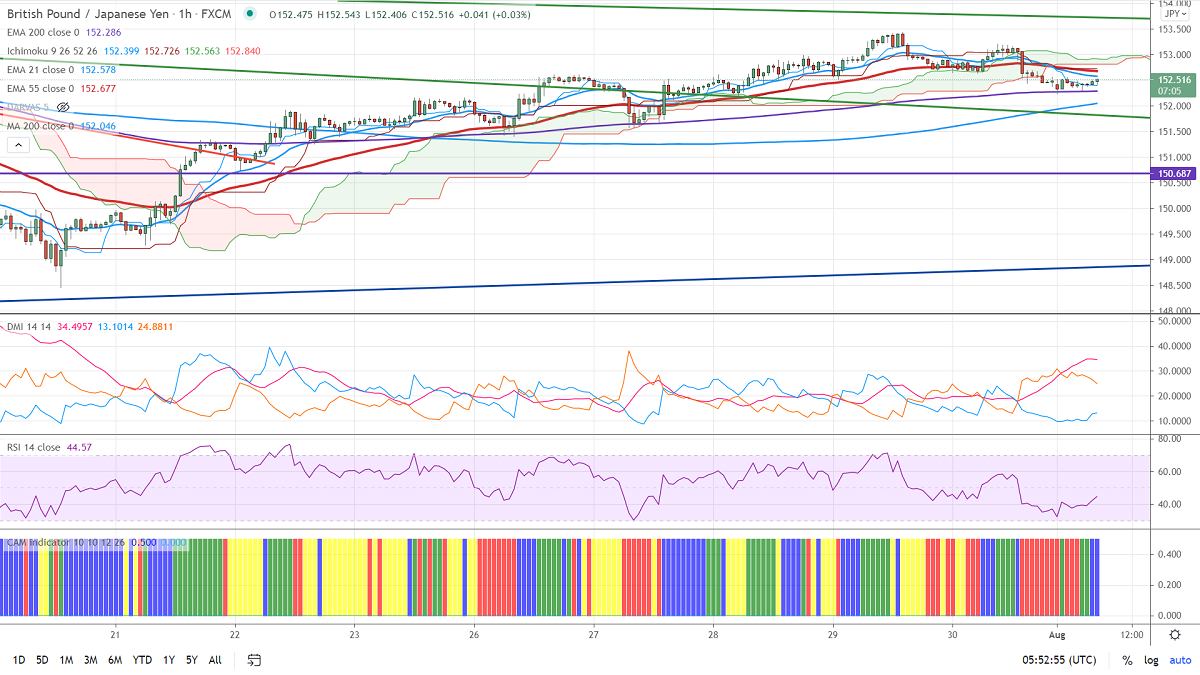

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 152.40

Kijun-Sen- 152.72

Previous week low – 148.45

GBPJPY is trading weak after hitting a high of 153.44 the previous week. The initial bias for the week remains neutral as long as resistance 156.05 holds. The minor pullback in yen due to a decline in US bond yield is putting pressure on this pair. GBPUSD is struggling to break above the 1.4000 level. Markets eye UK manufacturing PMI for further direction.

Technical:

The pair's immediate resistance is around 153.50, any violation above targets 154/155/156.05. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 152. Any indicative violation below targets 151.40/150.60/150/149. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 4-hour Tenken-Sen and below Kijun-Sen.

Indicator (1-Hour chart)

CAM indicator- Slightly Bullish

Directional movement index –Bearish

It is good to buy on dips around 152.40-45 with SL around 152 for TP of 155.