Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 151.67

Kijun-Sen- 151.48

Previous week high – 153.48

GBPJPY is trading higher on upbeat UK retail sales data. Ɪt came at 0.5% MoM in July compared to -0.2%. GBPUSD pared some of its gains made and is hovering near 1.3730. The pound sterling was one of the worst performers against USD in the past four weeks on board-based US dollar buying. The UK has reported 39916 cases in the last 24-hour and 84 deaths. GBPJPY hits an intraday low of 151.81 and is currently trading around 151.62.

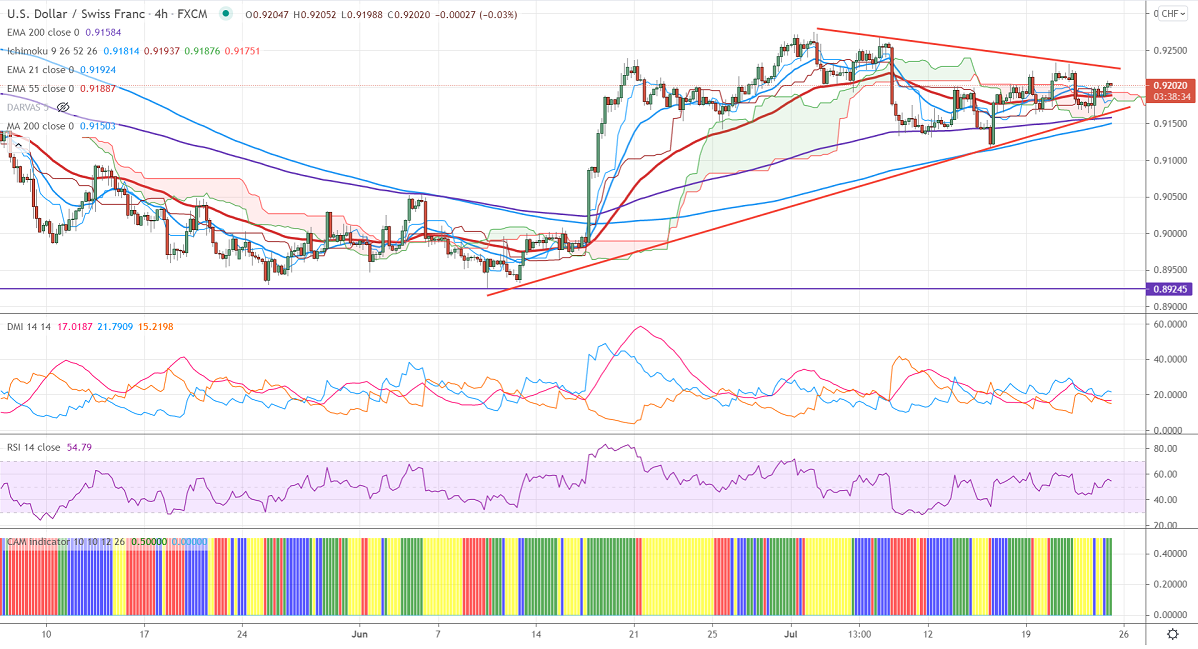

Technical:

The pair's near-term resistance is around 152.10, any break above targets 152.60/153/153.30. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 151.20. Any indicative violation below targets 150.60/150/149. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 1-hour Tenken-Sen and below Kijun-Sen.

Indicator (1-Hour chart)

CAM indicator-Bullish

Directional movement index –Bearish

It is good to buy on dips around 151.50 with SL around 150.60 for TP of 153.30.