Ichimoku Analysis (4-Hour Chart)

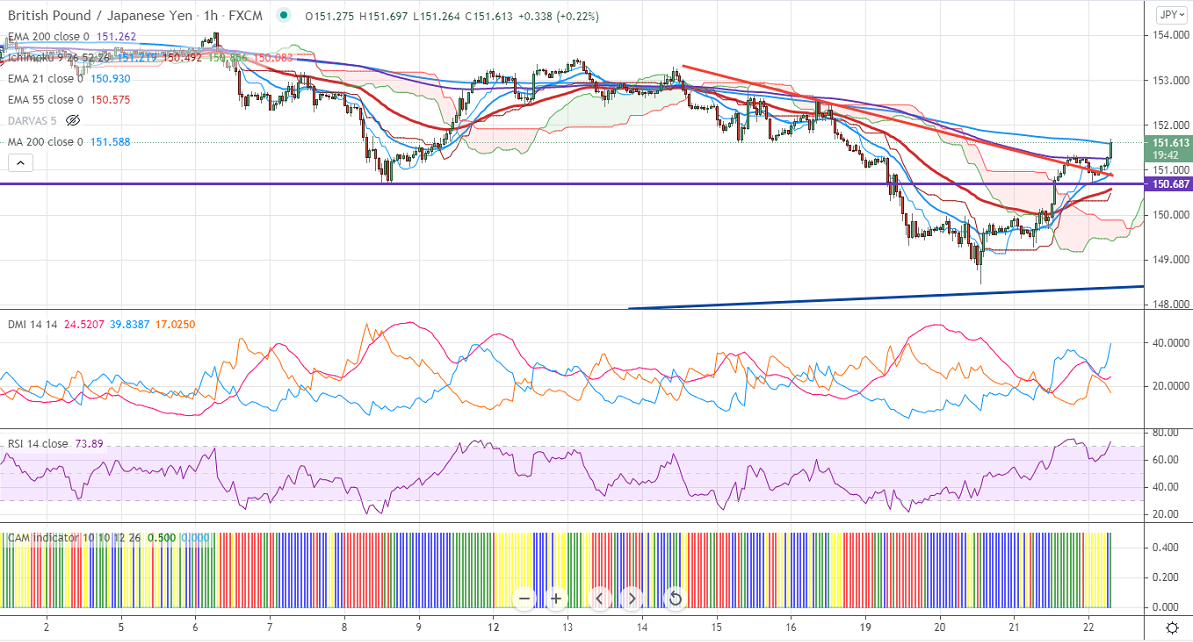

Tenken-Sen- 151.02

Kijun-Sen- 150.31

Previous week high – 153.48

GBPJPY has halted its six days of the bearish trend and shown a minor pullback. The pound sterling surged sharply against the USD despite a jump in coronavirus cases and Brexit uneasiness. The UK has reported a high number of daily coronavirus 44104 vs 42,302 last Wednesday. The European Union rejected UK demand for post-Brexit renegotiations with Northern Ireland. GBPJPY hits an intraday low of 149.96 and is currently trading around 149.57.

Technical:

The pair's near-term resistance is around 150, any break above targets 150.60/151.30/152. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 149. Any indicative violation below targets 148.40/148/147.40. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 1-hour Tenken-Sen and below Kijun-Sen.

Indicator (4-Hour chart)

CAM indicator-Bullish

Directional movement index –Bearish

It is good to sell on rallies around 150 with SL around 151 for a TP of 148.