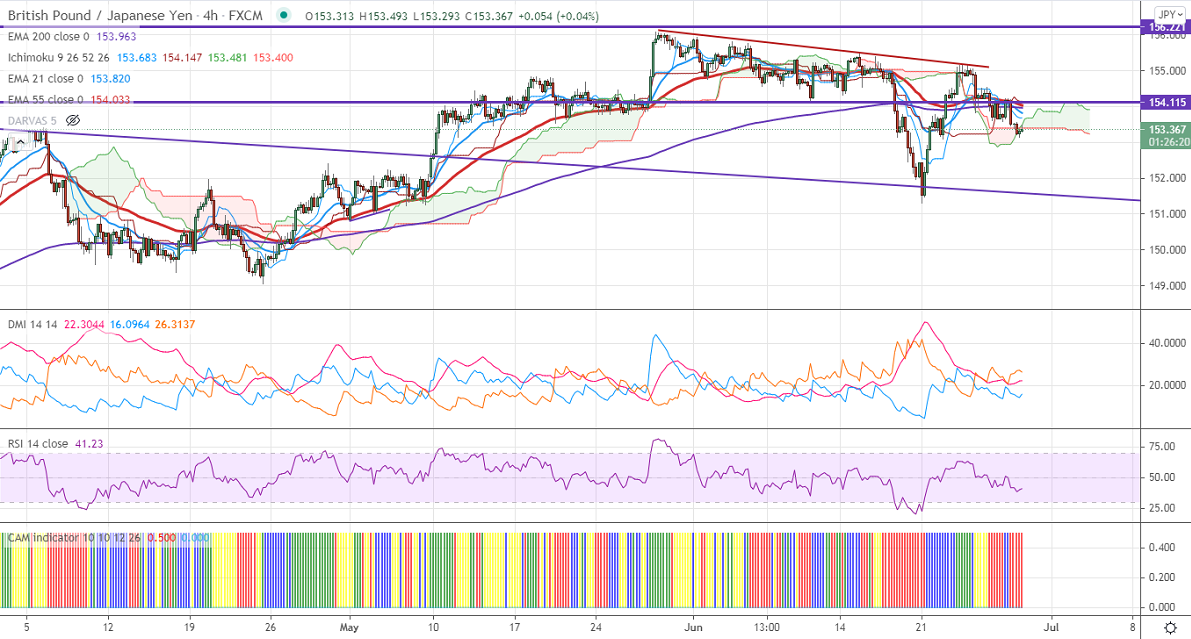

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.68

Kijun-Sen- 154.14

GBPJPY is trading lower for the fourth consecutive days and lost more than 200 pips on board-based pound sterling selling. GBPUSD is trading well below 1.3900 on a sudden spike number of coronavirus cases in the UK after five months. USDJPY is consolidating after a minor jump above 111.116. Any breach below 110.25 (23.6% fib) confirms further bearishness. GBPJPY hits an intraday low of 153.14 and is currently trading around 154.094.

Technical:

The pair's near-term resistance around 153.62, any break above targets 154.25/154.60/155.15. Major trend reversal only if it breaks 156.60. On the lower side, near-term support is around 153. Any indicative violation below that level will drag the pair down to 152/151.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 4-Hourly Kijun-Sen, Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 154.50-55 with SL around 155.15 for a TP of 153.