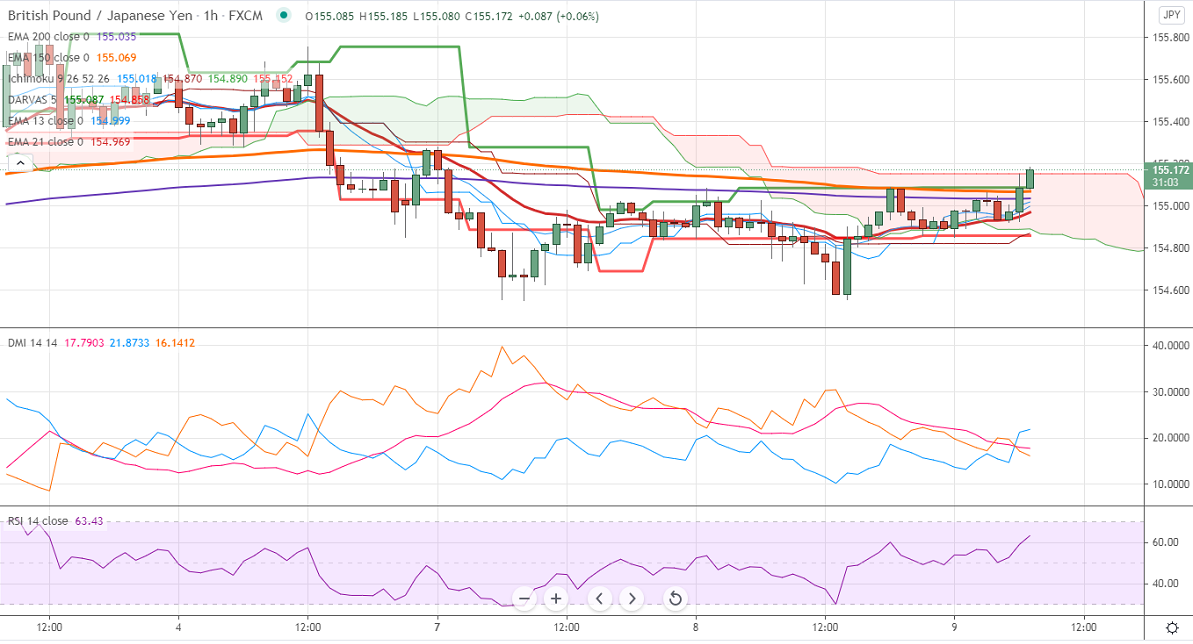

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 155

Kijun-Sen- 154.83

GBPJPY has formed a double bottom around 154.50 and shown a minor pullback. The short-term trend is still on the downside as long as resistance 156.10 holds. The pound sterling is trading flat against the USD. Market eyes UK-EU final negations regarding Northern Ireland. Any daily close above 1.4200 will take the pair to next level 1.4250. USDJPY trades in a narrow range between 109.20-109.60 for the past two days.

Technical:

The pair's near-term resistance around 155.30, any break above confirms intraday bullishness. A jump till 155.82/156.10/156.60 is possible. On the lower side, near-term support is around 154.50. Any indicative violation below that level will drag the pair down to 154.35/153.75/153. Significant trend reversal only if it breaks below 153.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen and Tenken-Sen.

Indicator (1-Hour chart)

RSI- Bearish

Directional movement index –Bearish

It is good to buy on dips around 155.05-10 with SL around 154.50 for a TP of 156.10.