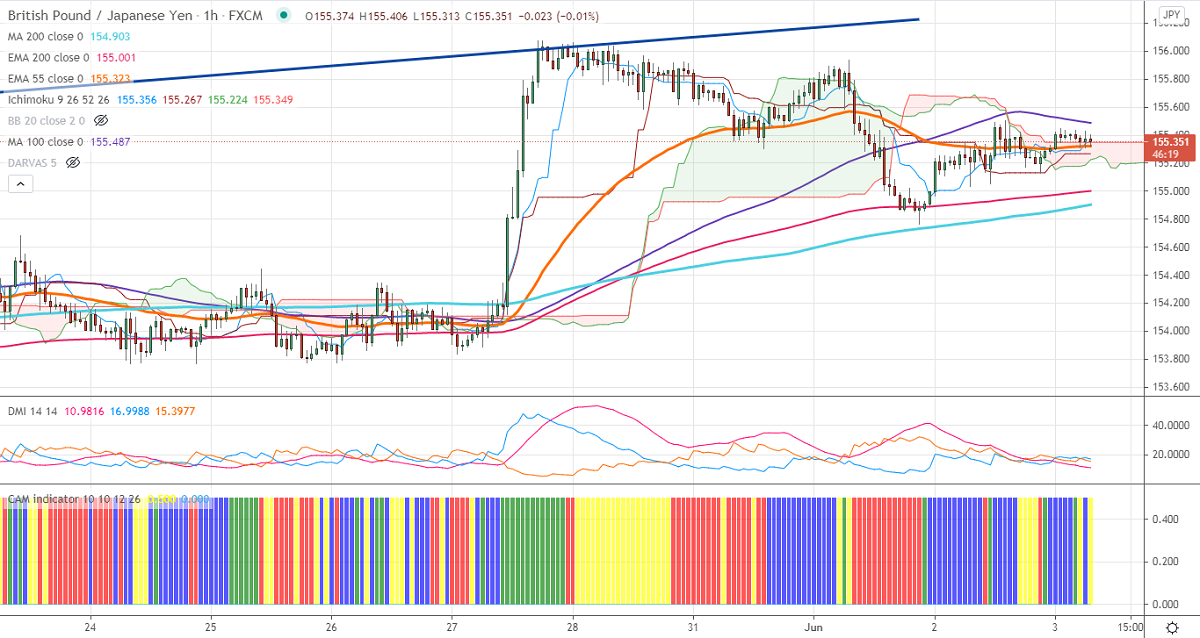

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 155.34

Kijun-Sen- 155.26

GBPJPY has taken support near 200-H MA and shown a minor pullback. The minor jump in pound sterling is supporting the pair at lower levels. GBPUSD is holding below 1.4180 levels ahead of UK services PMI data. The delay in lockdown restrictions due to the spread of the Indian corona variant is putting pressure on this pair. USDJPY is consolidating in a narrow range. Any surge past 110.20 confirms a bullish continuation. The intraday trend of GBPJPY is bullish as long support 154.60 holds.

Technical:

The pair's near-term resistance around 156.10, any break above confirms that decline from 195.25 got completed at 124.02. A jump till 157.50/158 is possible. On the lower side, near-term support is around 155.30. Any indicative violation below that level will drag the pair down to 154.75/154.35/153.75/153. Significant trend reversal only if it breaks below 153.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen and Tenken-Sen.

Indicator (1-Hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to buy on dips around 155 with SL around 154 for a TP of 157.50.