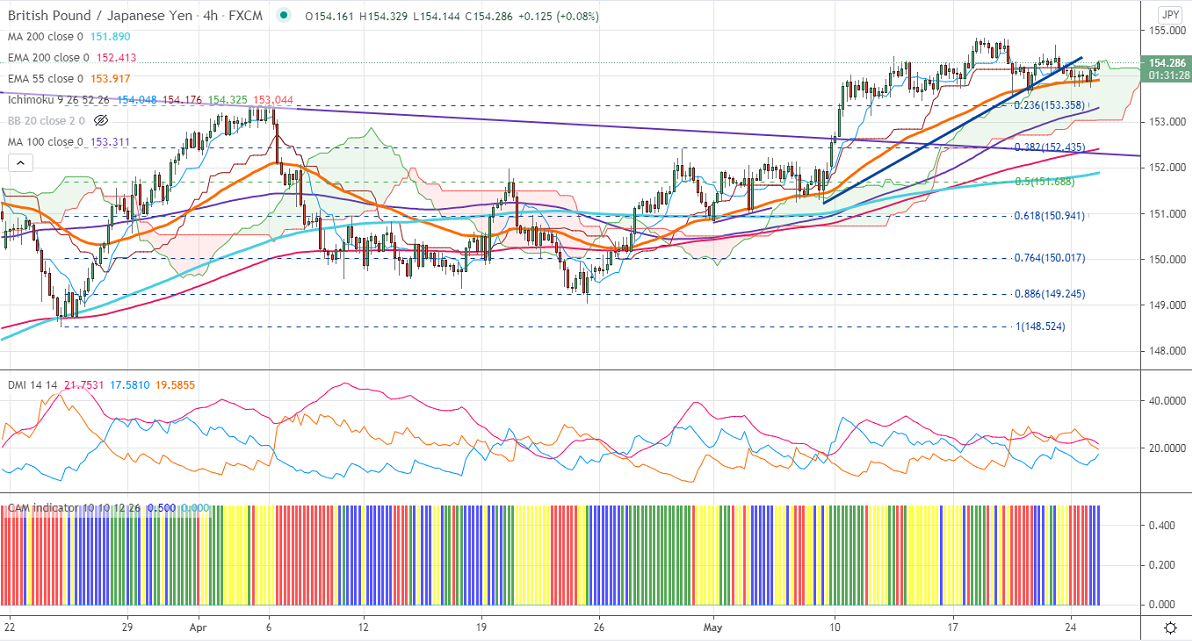

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 154.05

Kijun-Sen- 154.18

GBPJPY has recovered slightly after a minor decline to 153.76. The slight pullback in Pound sterling is supporting the pair at lower levels. GBPUSD has taken support near 200-H MA and jumped despite Brexit concerns. The board-based US dollar selling is pushing the pound sterling further higher. Any breach above 1.42500 confirms a bullish continuation. USDJPY has once again traded below 109, a dip below 108.50 will take the pair to 108.20. The intraday trend of GBPJPY is bearish as long resistance 155 holds.

Technical:

The pair's near-term resistance around 155, any break above will take the pair to next level till 156/156.60. On the lower side, near-term support is around 153.75. Any indicative violation below that level will drag the pair down to 153.35/153/152.39. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and cloud.

Indicator (4-Hour chart)

CAM indicator – Slightly Bullish

Directional movement index –Bearish

It is good to sell on rallies around 154.30-35 with SL around 155 for a TP of 152.