Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.90

Kijun-Sen- 153.19

GBPJPY is consolidating in a narrow range between 153.51 and 154.40 for the past three days. The pound sterling declined to 1.4000 on the steadier dollar due to a surge in US inflation. GBPUSD should break below 1.4000 for further weakness. USDJPY is trading flat and any jump above 110 will take the pair to 111. The intraday trend of GBPJPY is bullish as long support 153.40 holds.

Technical:

The pair's near-term resistance around 154.50, any break above will take the pair to next level till 155/156. On the lower side, near-term support is around 153.50. Any indicative violation below that level will drag the pair down to 152.80/152.30/152. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and cloud.

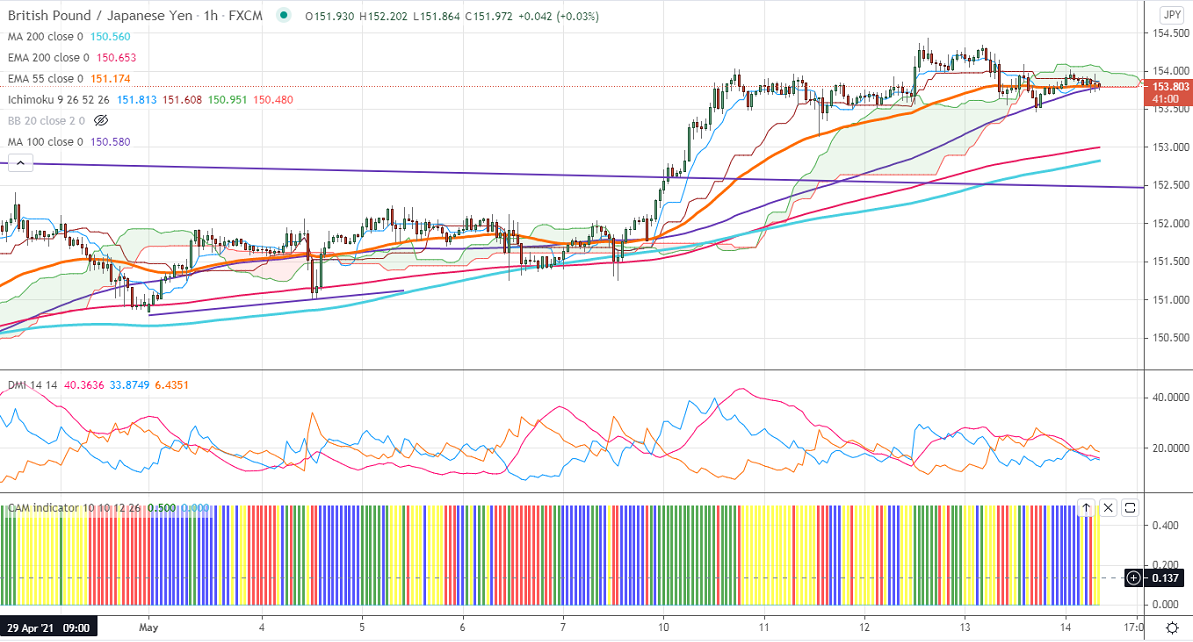

Indicator (1-Hour chart)

CAM indicator –Neutral

Directional movement index –Bullish

It is good to buy on dips around 153.25-30 with SL around 152.80 for a TP of 155.