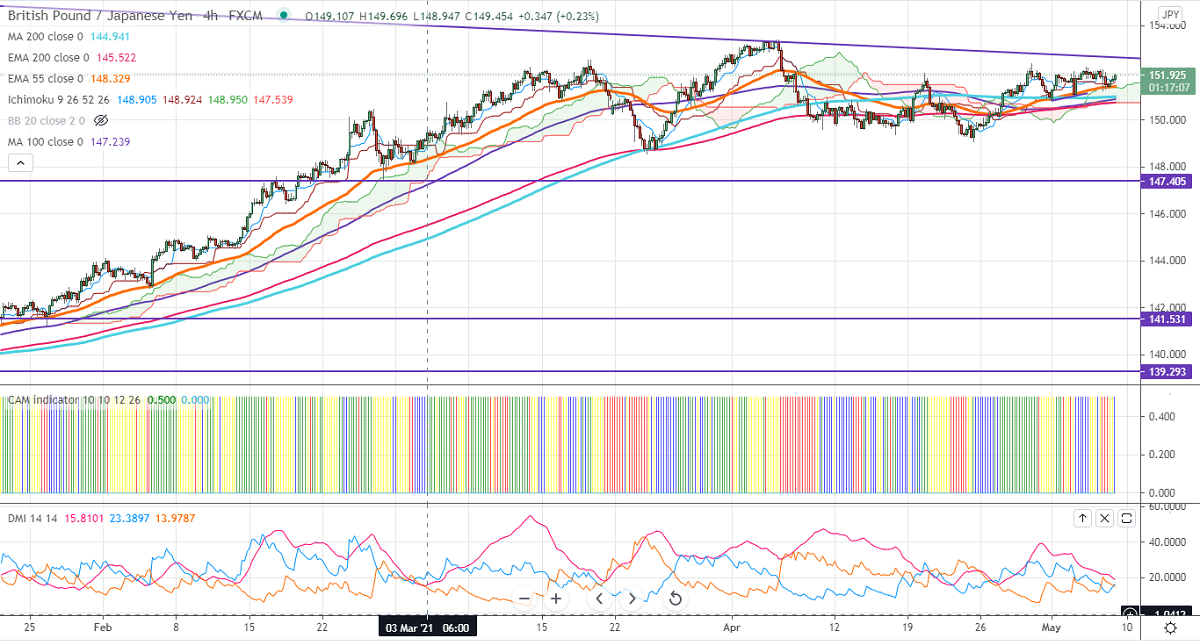

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 151.68

Kijun-Sen- 151.53

GBPJPY has once again recovered after hitting a low of 151.26. The Bank of England has kept its rates unchanged as expected and slowed its bond-buying program of 3.4 billion a week from its current pace of 4.4 billion pounds a week. It has revised up the economic forecast for 2021 and 2022. USDJPY paired some of the gains on hopes of a rate hike by the Fed. The minor sell-off in bond yields is also supporting the Japanese yen. The intraday trend of GBPJPY is bullish as long support 151 holds.

Technical:

The pair's near-term resistance around 152.40, any break above will take the pair to next level till 152.81 (trend line resistance) /153.40. On the lower side, near-term support is around 151.50. Any indicative violation below that level will drag the pair down to 151.10/150.80/150.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and below Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator –Slightly bullish

Directional movement index –Neutral

It is good to buy on dips around 151.50 with SL around 151 for a TP of 153/153.40.