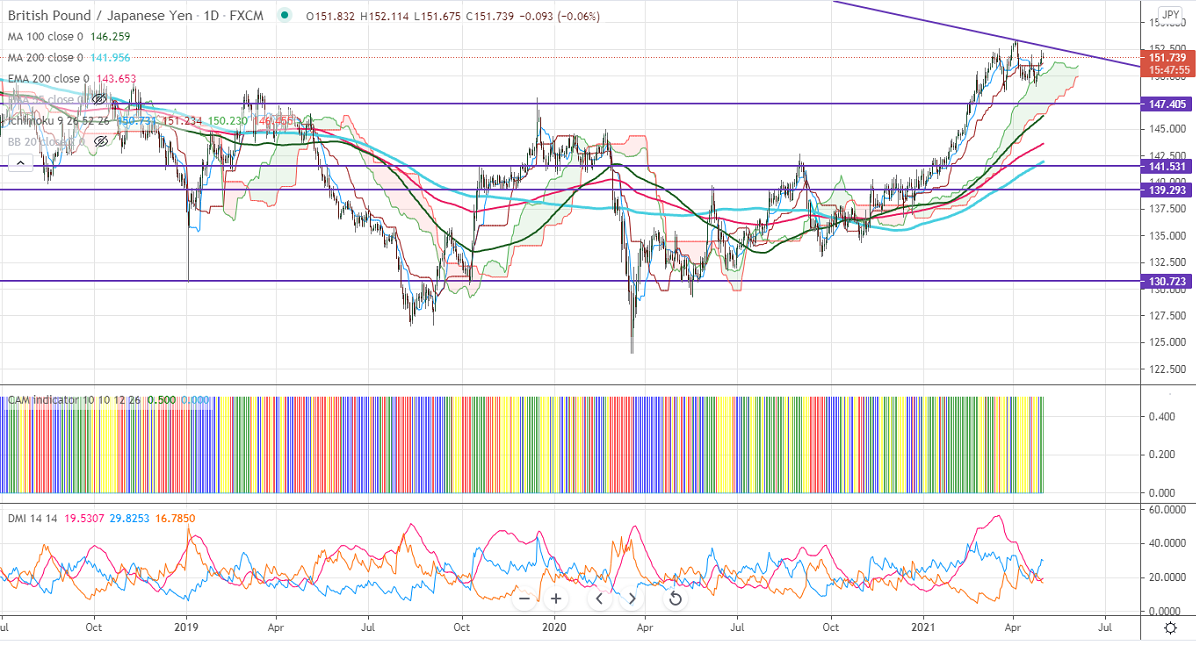

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 150.73

Kijun-Sen- 151.06

GBPJPY has shown a minor sell-off after a jump of 152.40. The pair was one of the best performers this week and surged more than 250 pips on weak Japanese yen. The upbeat market sentiment and bullish US bond yields are dragging the Japanese yen. USDJPY is facing strong resistance around 109.25, any break above confirms a bullish continuation. GBPUSD is consolidating in a narrow range for the past two days. It should break 1.4000 for further up move. The intraday trend of GBPJPY is bullish as long as support 151 holds.

Technical:

The pair's near-term resistance around 152.81 (trend line resistance) any close break above confirms trend reversal. A jump till 153.40/154/155 is possible. On the lower side, near-term support is around 151.60. Any indicative violation below that level will drag the pair down to 151/150.30/150/149.30/148.40. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading well above daily Kijun-Sen and below Tenken-Sen, cloud.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 151.60 with SL around 151 for a TP of 153/153.40.