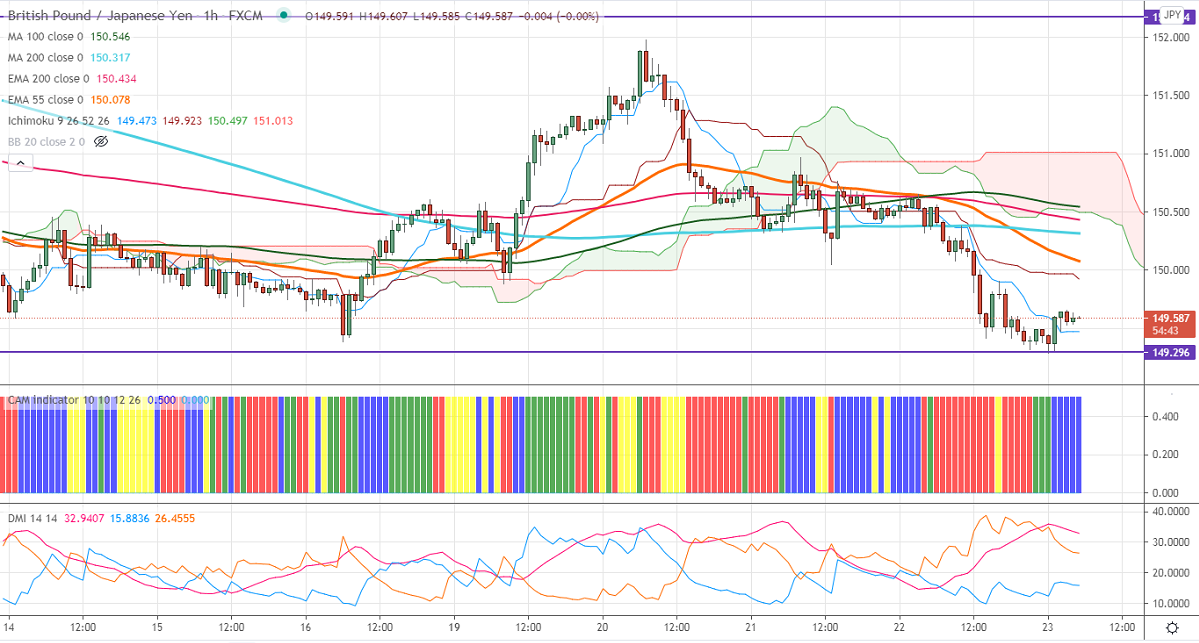

Ichimoku Analysis (one Hour Chart)

Tenken-Sen- 149.96

Kijun-Sen- 149.51

GBPJPY lost more than 100 pips yesterday due to strength in the Japanese Yen. The slight weakness in US bond yield and surge in coronavirus cases has increased demand for safe-haven assets like yen, gold. USDJPY is trading slightly below 55- day EMA and a dip till 107.60 is possible. GBPUSD continues to trade weak on Brexit worries and surge in coronavirus cases. Markets eye UK retail sales and flash manufacturing PMI data for further direction. The intraday trend of GBPJPY is bearish as long as support 151 holds.

Technical:

The pair's near-term resistance around 150 any break above targets 150.55/151/151.60/152/152.55. On the lower side, near-term support is around 149.30. Any indicative violation below that level will drag the pair down to 149/148.40. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading slightly below Hourly Kijun-Sen and below Tenken-Sen, cloud. Any break below 149.30 confirms intraday bearishness.

Indicator (4-Hour chart)

CAM indicator –Slightly bullish

Directional movement index –Bearish

It is good to sell on rallies around 150 with SL around 150.60 for a TP of 148.4/147.40.