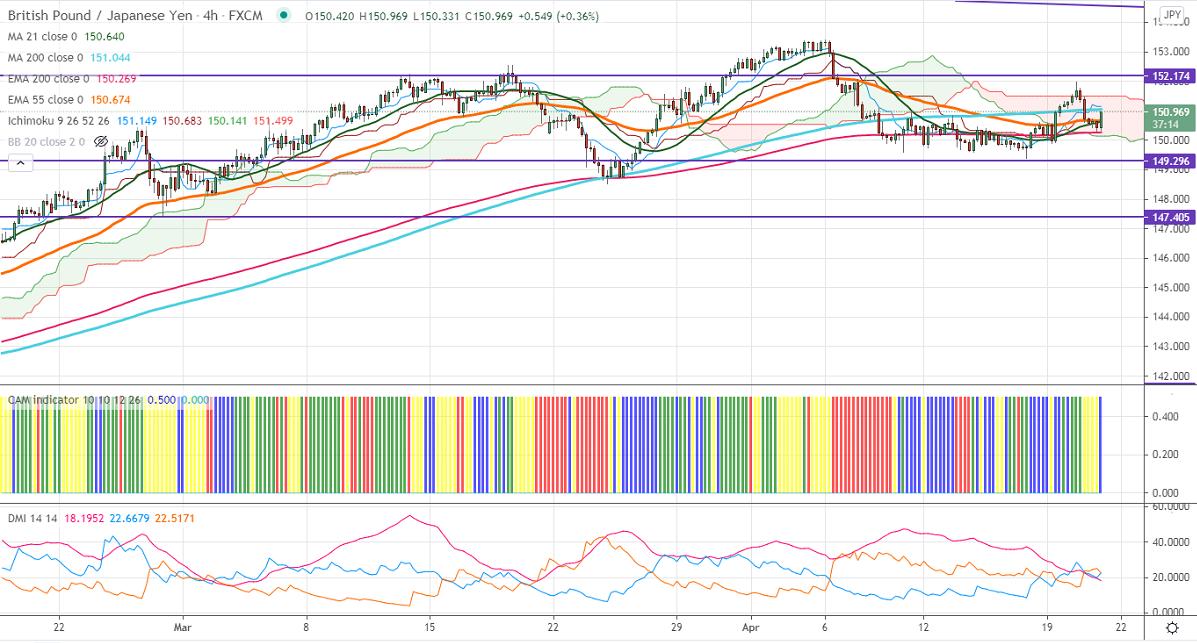

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 151.14

Kijun-Sen- 150.68

GBPJPY has halted its five days of the bullish trend and declined more than 150 pips on broad-based Yen buying. USDJPY hits multi-week lows on declining US bond yield. Any dip below 107.90 confirms a bearish continuation. The reduced hopes of a rate hike by the Fed and fast vaccine rollout is putting pressure on the US dollar. GBPUSD declined more than 70 pips from a seven-week high on surging coronavirus cases and mixed UK data. UK CPI came at 0.70% in Mar compared to a forecast of 0.8%. The intraday trend of GBPJPY is bullish as long as support 150.30 holds.

Technical:

The pair's near-term resistance around 151.20 any break above targets 151.60/152/152.55. On the lower side, near-term support is around 150.30. Any indicative violation below that level will drag the pair down to 150/149.30/149/148.40. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading slightly above 4H Kijun-Sen and below Tenken-Sen, cloud. Any break below 150.30 confirms intraday bearishness.

Indicator (4-Hour chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to buy on dips around 150.70-75 with SL around 150.30 for a TP of 152.