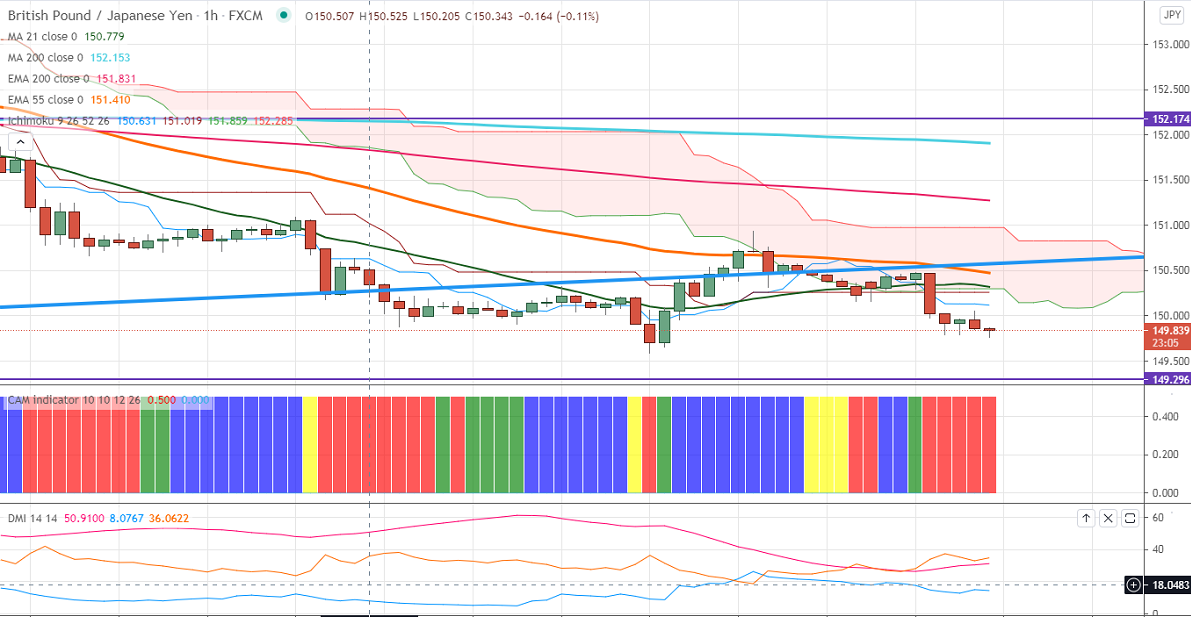

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- 150.13

Kijun-Sen- 150.26

GBPJPY is trading weak after a minor jump to 150.93 levels. The intraday trend is still weak as long as resistance 151.20 holds. The weakness in the pound sterling is putting pressure on this pair. GBPUSD lost more than 250 pips from the previous week's high of 1.39180. The AstraZeneca coronavirus vaccine issue is weighing on Pound. USDJPY has taken support near 200-W MA and shows a minor recovery.

Technical:

The pair's near-term resistance around 150.50, any break above targets 151.20/152/153. On the lower side, near-term support is around 149.50. Any indicative violation below that level will drag the pair down to 149/148.50/148. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading well below 4-hour Kijun-Sen, Kijun-Sen, and cloud. Any break below 149.50 confirms intraday bearishness.

Indicator (4-Hour chart)

CAM indicator –Neutral

Directional movement index –Bearish

It is good to sell on rallies around 151 with SL around 152 for a TP of 148.50