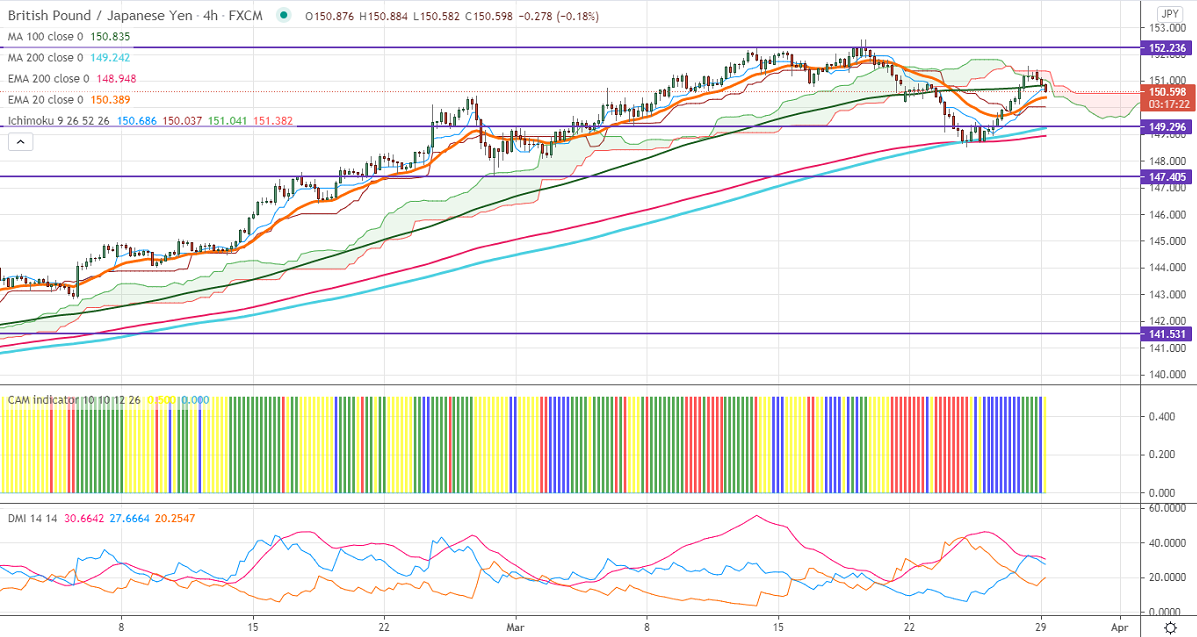

Ichimoku Analysis (4 Hour Chart)

Tenken-Sen- 150.68

Kijun-Sen- 150.03

GBPJPY has taken support near 200-4H MA and shown a nice recovery of more than 300 pips on weak yen. The yen was one of the worst performers in the previous week against the US dollar despite surging US bond yield. USDJPY jumped more than 150 pips for a low of 108.40, any further bullishness only if it breaks above 110. The pound sterling is holding below 1.3800 level broad-based US dollar buying. The intraday trend of GBPJPY is bearish as long as resistance 152.55 holds.

Technical:

The pair's near-term resistance around 151.20, any break above targets 151.60/152/152.55. On the lower side, near-term support is around 150.36. An indicative violation below will drag the pair down to 150/149.21/148.50. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 4-hour Tenken-Sen, below Ichimoku cloud, and slightly above Kijun-Sen. This confirms the intraday trend of slightly bearish

Indicator (4 Hour chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to sell on rallies around 151 with SL around 152 for the TP of 148.50.