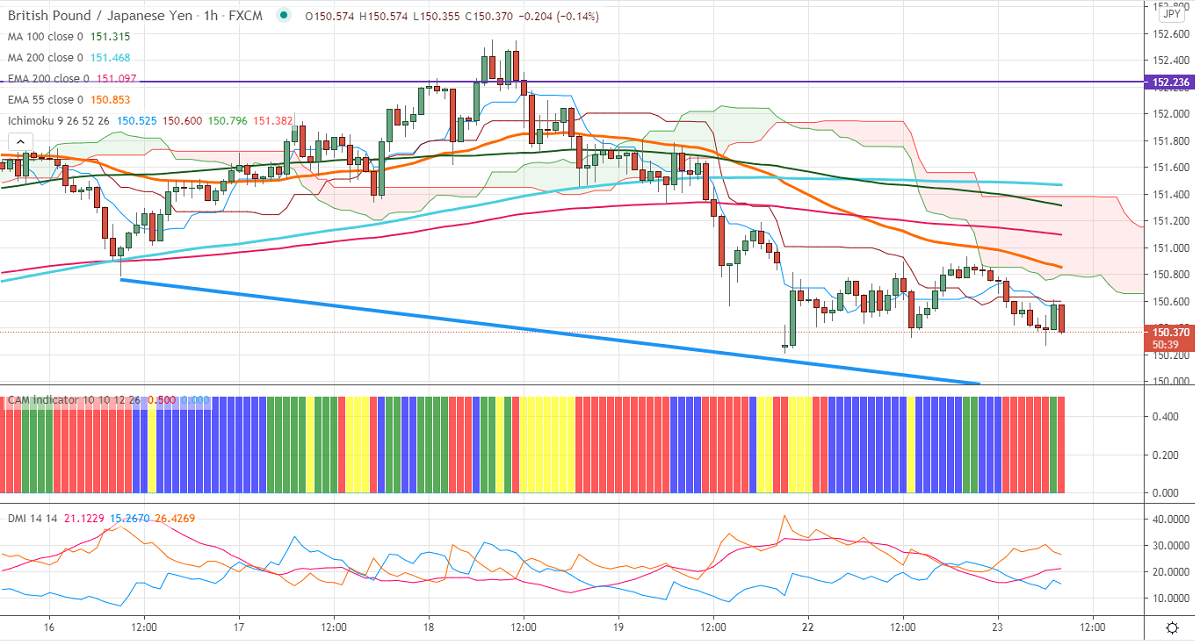

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 150.55

Kijun-Sen- 150.60

GBPJPY is trading in a narrow range between 150.21 and 150.93 for the past two trading days. The minor strength in yen despite strong US bond yield. USDJPY has formed a top around 109.35 and declined slightly on increasing demand for safe-haven assets. Any violation below 108.50 confirms minor weakness. GBPUSD is holding below 1.3850 on mixed jobs data. UK unemployment rate declined to 5% compared to a forecast of 5.2%. While Feb jobless claims change 86.5k vs -20k. The intraday trend of GBPJPY is bearish as long as resistance 152.55 holds.

Technical:

The pair's near-term resistance around 150.85, any break above targets 151.52/152/152.55. On the lower side, near-term support is around 150.20. An indicative violation below will drag the pair down to 149.95/149.35/149/148.54.

Ichimoku Analysis- The pair is trading below Tenken-Sen, Kijun-Sen, and Ichimoku cloud. This confirms intraday bearishness.

Indicator (Hourly chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to sell on rallies around 150.65-70 with SL around 151.20 for the TP of 148.55.