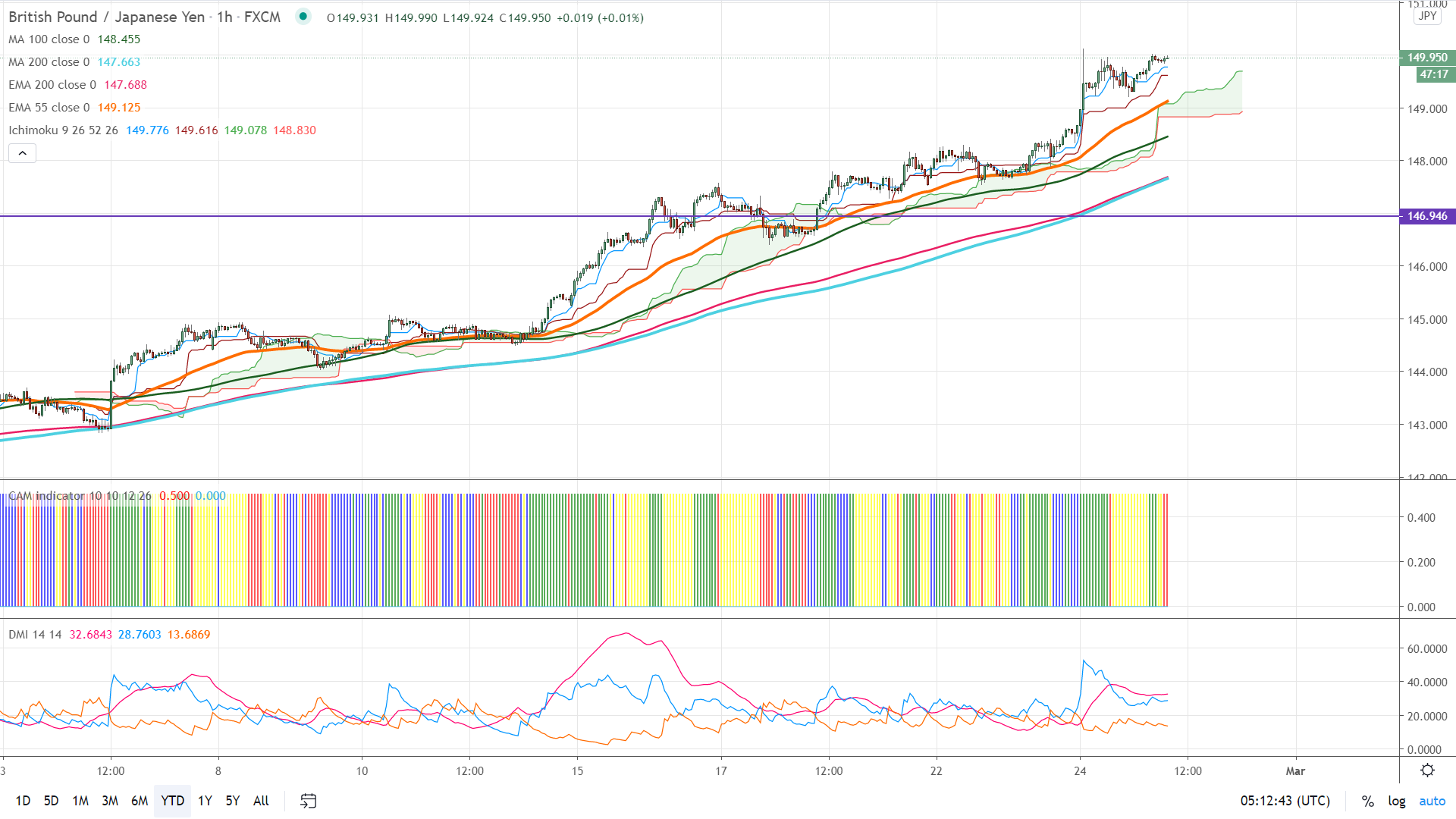

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 149.77

Kijun-Sen- 149.61

GBPJPY continues to trade higher for the past six weeks and surged more than 900 pips on the strong pound sterling. GBPUSD is holding above1.4100 in the UK easing lockdown restrictions and vaccine rollout. UK Chancellor is expected to give budget which will be a boom to the economy also supporting pound. USDJPY is struggling to close above 106 level, major bullishness only above 106.40. The intraday trend of GBPJPY is bullish as long as 149.20 holds.

Technical:

The pair is facing significant resistance at 150.10, a jump till 151.20/154.50 possible. On the lower side, near-term support is around 149.20. An indicative break below will drag the pair down to 148.40/147.80. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (Hourly chart)

CAM indicator –Bearish

Directional movement index – Bearish

It is good to buy on dips around 149.25-30 with SL around 148.20 for the TP of 151.50.