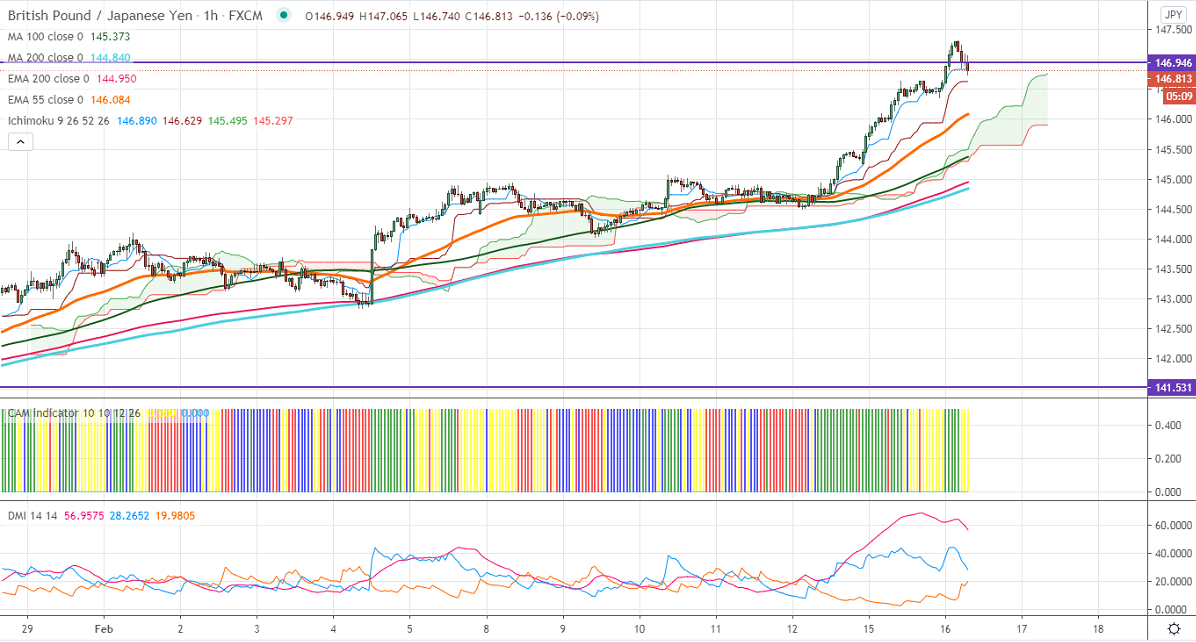

Ichimoku Analysis (1-hour Chart)

Tenken-Sen- 144.74

Kijun-Sen- 143.29

GBPJPY is trading higher for an eleventh consecutive week and surged more than 1000 pips on the strong Pound sterling. GBPUSD holding well above and hits the highest level since Apr 2018. The GBP prices are supported by coronavirus vaccine rollout and a decline in the number of new cases in the UK. The yen continues to trade lower against the US dollar, the intraday trend reversal only above 105.78.

Technical:

The pair's significant resistance at 147.30, any convincing break above targets 148. The decline from 156.60 will get completed at 123.99 once if it breaks 148. A jump till 150/151.20 possible. On the lower side, near term support is around 146/145.65/145.Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (1-hour chart)

CAM indicator –Neutral

Directional movement index – neutral

It is good to buy on dips around 146 with SL around 145 for the TP of 146.81/148.