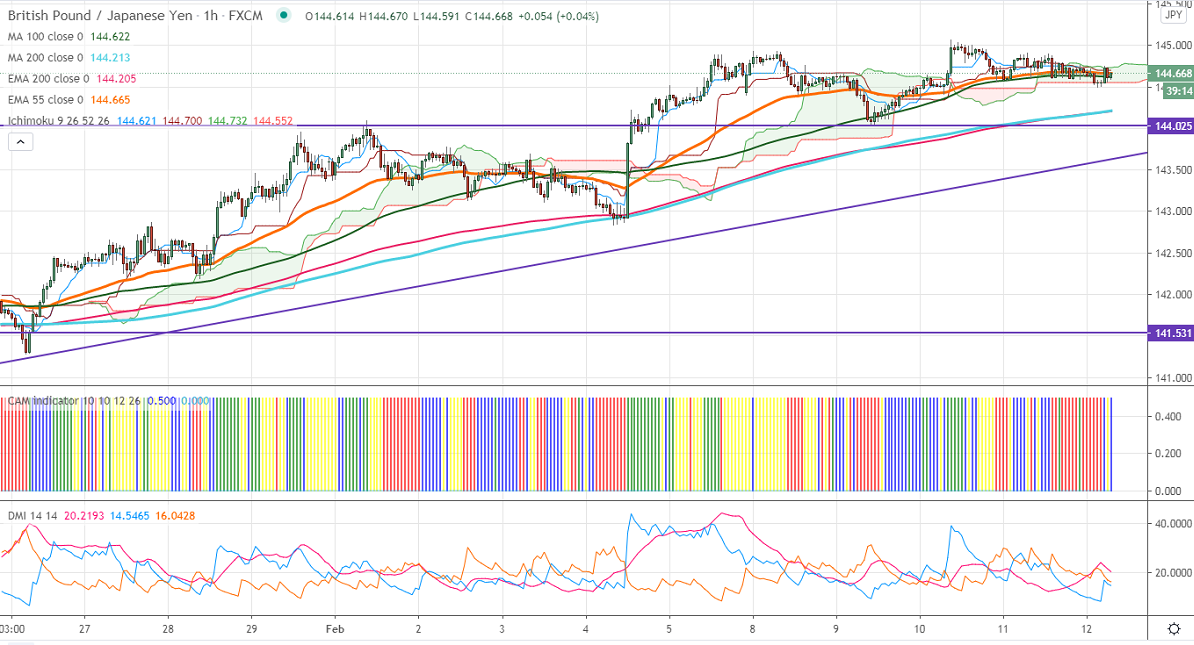

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 144.63

Kijun-Sen- 144.70

GBPJPY is consolidating in a narrow range between 145.06 and 144.037 for the past three days. The slight weakness in the pound sterling is putting pressure on this pair at higher levels. GBPUSD trades below 1.3800 despite strong UK GDP. The UK economy has grown by 1% in Q4 much better than the forecast of 0.5%. USDJPY's intraday trend reversal only above 105.05.

Technical:

The pair's significant resistance at 145, any convincing break above targets 146.81/147.95. The decline from 156.60 will get completed at 123.99 once if it breaks 148. On the lower side, near term support is around 144.50, and any violation below targets 144. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (1-hour chart)

CAM indicator –neutral

Directional movement index – Neutral

It is good to buy on dips around 144.10-15 with SL around 142.85 for the TP of 146.