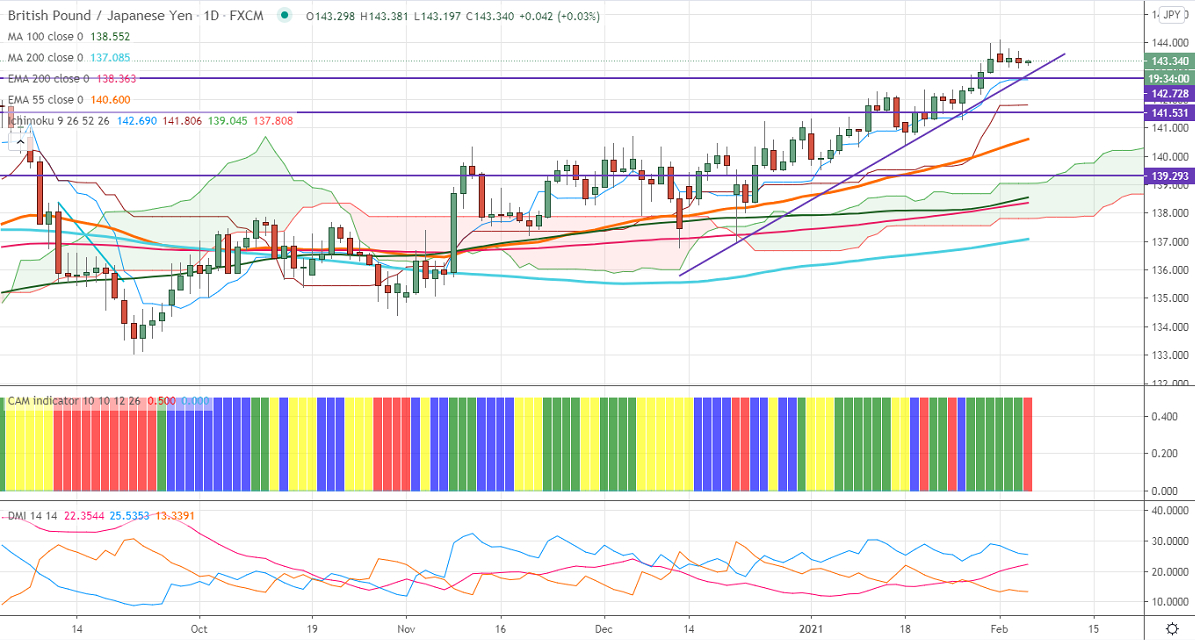

Candlestick pattern- Shooting star (Daily chart)

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 142.69

Kijun-Sen- 141.79

GBPJPY is declining after hitting a multi month high at 144.09. The slight weakness in the Pound sterling is putting pressure on this pair at higher levels. Short term trend is slightly bullish as long as support 143 holds. The decrease in the demand for safe-haven is pushing USDJPY prices higher. Any violation above 105.67 (200- day MA) targets 106.25/106.50. Markets eye BOE policy meeting for further direction.

Technical:

The pair's significant resistance at 144.10, any convincing break above targets 145/146.10. On the lower side, near term support is around 143, and any violation below targets 142.20/141.80/141.20.

Indicator (4-hour chart)

CAM indicator –Bearish

Directional movement index – Bullish

It is good to sell below 143 with SL around 142.15 for the TP of 145/146.