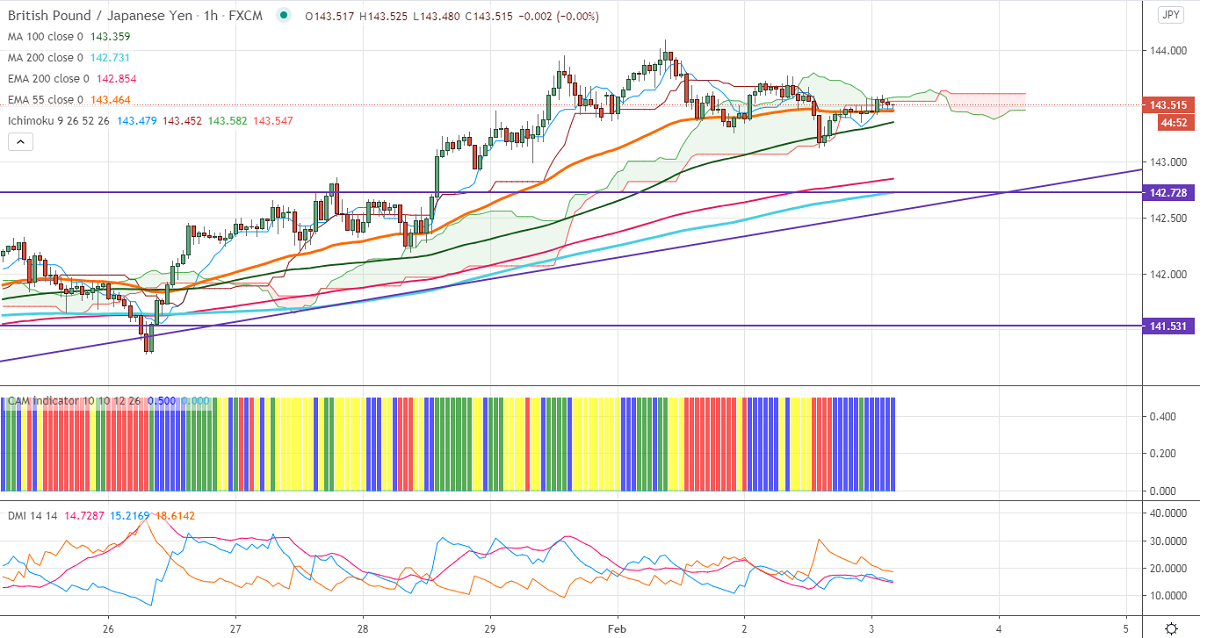

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 143.479

Kijun-Sen- 143.452

GBPJPY is consolidating after hitting an 11-month high around 144.098 levels. Short term trend is bullish as long as support 142.15 holds. The surge in global markets and coronavirus vaccine rollout has decreased demand for safe-haven assets like the yen. USDJPY is consolidating in a narrow range, violation above 105.67 (200- day MA) targets 106.25/106.50. The pair is holding above significant resistance 142.71 confirms that the decline from 147.95 got completed at 123.58.

Technical:

The pair's significant resistance at 144.10, any convincing break above targets 145/146.10. On the lower side, near term support is around 142.70, and any violation below targets 142.20/141.80/141.20.

It is good to buy on dips around 142.75-80 with SL around 142.15 for the TP of 145/146.