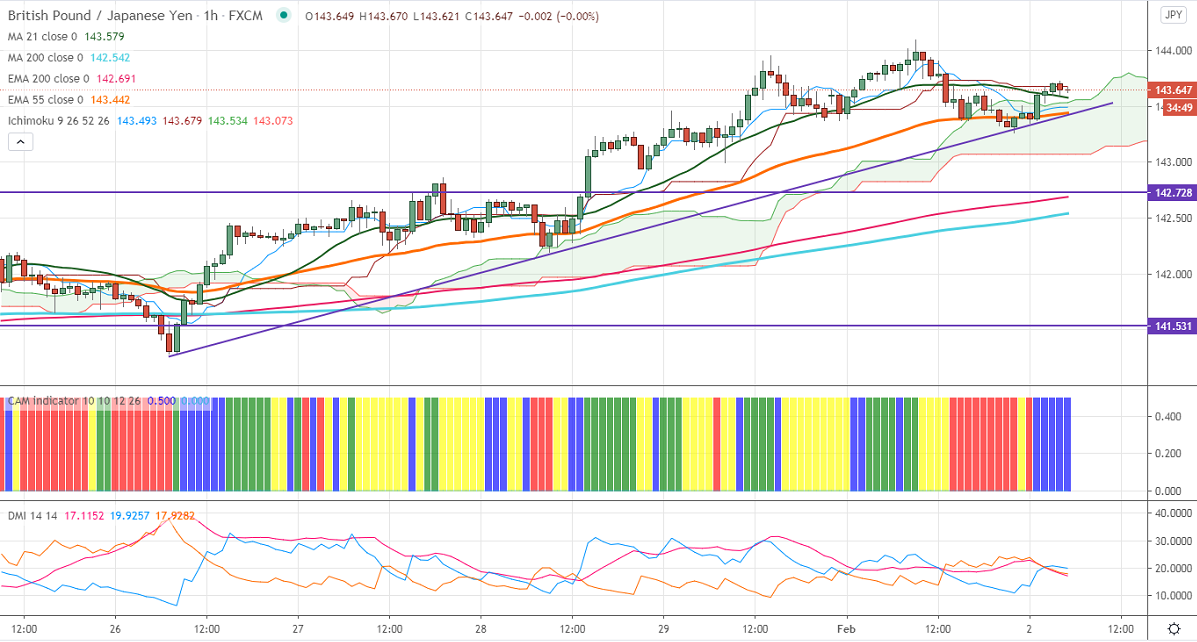

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 143.49

Kijun-Sen- 143.67

GBPJPY has taken support near the trend line and shown a recovery of 50 pips. The weakness in yen due to an increase in demand for risk appetite. USDJPY is holding well above 55- day EMA, with a significant trend reversal only above 105.67 (200- day MA). The Intraday trend of GBPJPY is bullish as long as support 142.50 holds. The pair is holding above significant resistance 142.71 confirms that the decline from 147.95 got completed at 123.58.

Technical:

The pair's significant resistance at 144.10, any convincing break above targets 145/146.10. On the lower side, near term support is around 142.75, and any violation below targets 142.20/141.80/141.20.

It is good to buy on dips around 143.25-30 with SL around 142.20 for the TP of 145/146.