FxWirePro: GBPJPY Daily Outlook

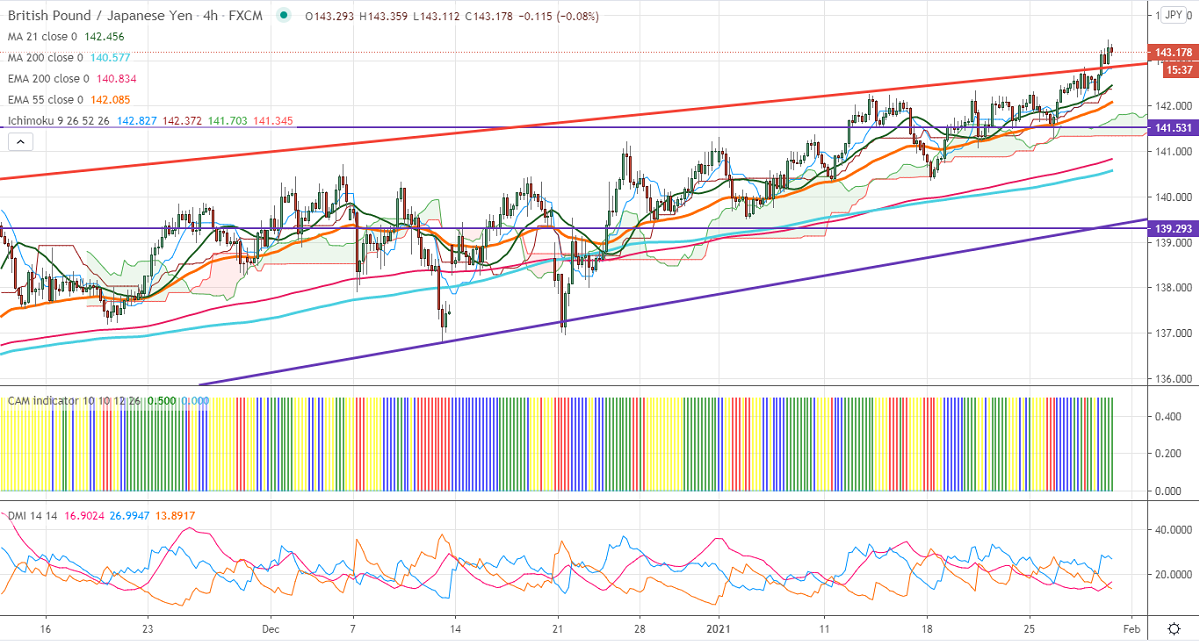

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- 142.82

Kijun-Sen- 142.37

GBPJPY is trading higher and holding well above trend line resistance. The break above 142.70 confirms that the pair has formed temporary bottom around 133.04. The pound sterling has once again declined after touching 1.37458 against USD. A surge above 1.2760 confirms a bullish continuation. USDJPY hits 2- week high and scope for reaching 105.38 is possible. The Intraday trend of GBPJPY is bullish as long as support 141.79 holds.

Technical:

The pair's significant resistance at 143.60, any convincing break above targets 144/145. On the lower side, near term support is around 142.78, and any violation below targets 142.39/141.80/141.20.

It is good to buy on dips around 142.80 with SL around 142.40 for the TP of 144/145.