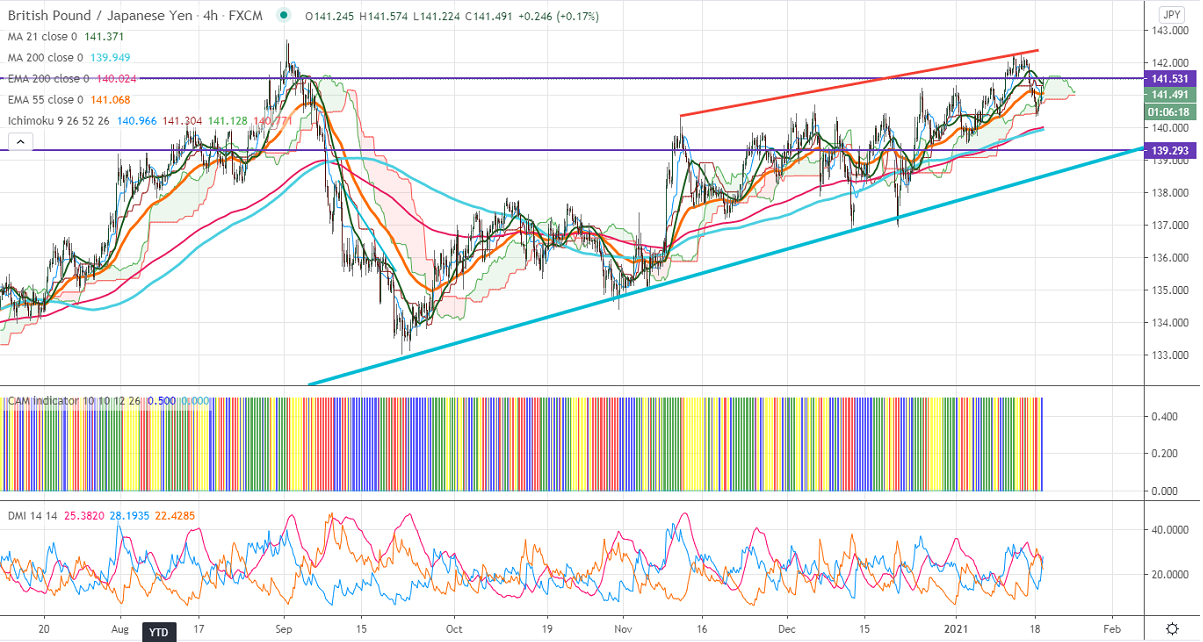

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- 140.85

Kijun-Sen- 141.30

GBPJPY recovered more than 100 pips from a low of 140.35 on weak yen. The surge in US bond yield and upbeat market sentiment is putting pressure on the Japanese yen. USDJPY's significant resistance at 104.20, violation above targets 104.65/105. The intraday trend is bullish as long as support 140.35 holds.

Technical:

The pair's significant resistance at 141.60, any indicative break above targets 142.25/142.70.Primary trend continuation only if it goes past 142.70.A jump till 144/145 likely. On the lower side, near term support is around 141.05 (55- 4H EMA), and any violation below targets 140.30/139.95.

It is good to buy on dips around 141.25-30 with SL around 140.80 for the TP of 142.25.