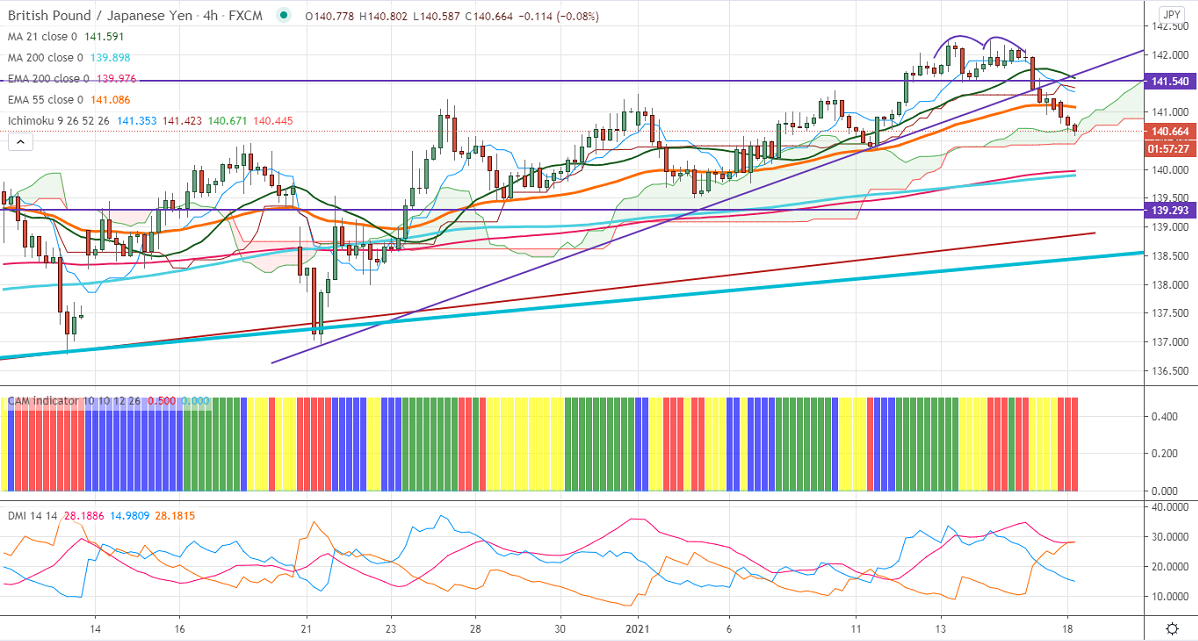

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- 141.38

Kijun-Sen- 141.45

GBPJPY continues to trade weak for third consecutive days after forming a top around 142.259. The intraday trend is bearish as long as resistance 142.25 holds. The pound sterling has formed a double top around 1.3700 and shown more than 150 pips.

Technical:

The pair's significant resistance at 142.25, any indicative break above targets 142.70. Significant trend continuation only if it goes past 142.70.A jump till 144/145 likely. On the lower side, near term support is around 140.30, and any violation below targets 140/139.50.

It is good to sell on rallies around 141 with SL around 141.50 for the TP of 139.55.