• GBP/AUD strengthened on Wednesday as downbeat Australian GDP data and worries about the Omicron variant weighed on Australian dollar.

• Data showed Australia's economic growth slowed to 3.9% in the third quarter from 9.6% during the prior three-month period.

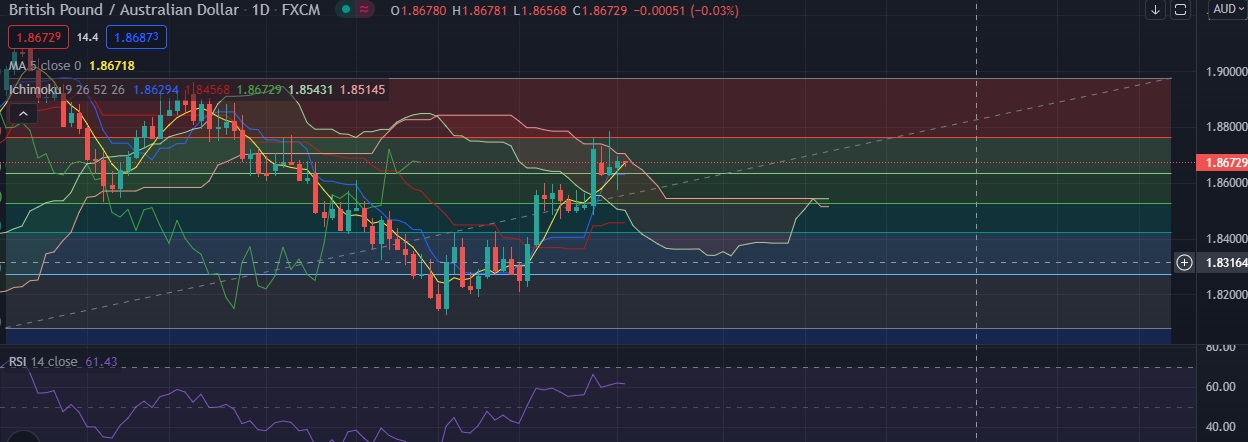

• GBP/AUD remains bullish, only a break and daily close above 1.8527 (23.6% fib) will shift bias to the downside.

• Technical are bullish, daily RSI is positive at 61, daily momentum studies 14 and 21 DMAs are trending up.

• Immediate resistance is located at 1.8706 (Ichimoku Cloud Top ), any close above will push the pair towards 1.8764(23.6%fib).

• Strong support is seen at 1.8631 (38.2%fib) and break below could take the pair towards 1.8527(50%fib).

Recommendation: Good to buy around 1.8670, with stop loss of 1.8550 and target price of 1.8740