• GBP/USD slipped lower on Friday but downside was limited as investors digested U.S. inflation data.

• The personal consumption expenditures price index, the Federal Reserve's preferred measure of inflation, increased by 0.1% in August, following a revised 0.2% rise in July.

• The U.S. data increased the likelihood of a substantial interest rate cut at the Fed's November policy meeting.

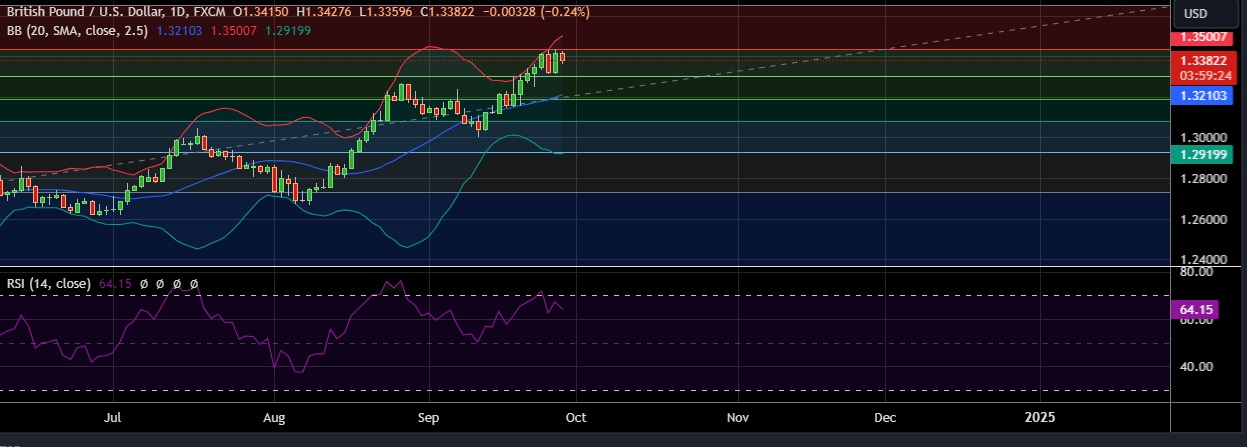

• Technical signals are strongly bullish as RSI is at 64 , daily momentum studies 5, 9 and 10 DMAs are trending up.

• Immediate resistance is located at 1.3430( 23.6%fib), any close above will push the pair towards 1.3458 ( Higher BB)

• Strong support is seen at 1.3374(5DMA) and break below could take the pair towards 1.3305 (38.2% fib).

Recommendation: Good to buy around 1.3370 with stop loss of 1.2980 and target price of 1.3430