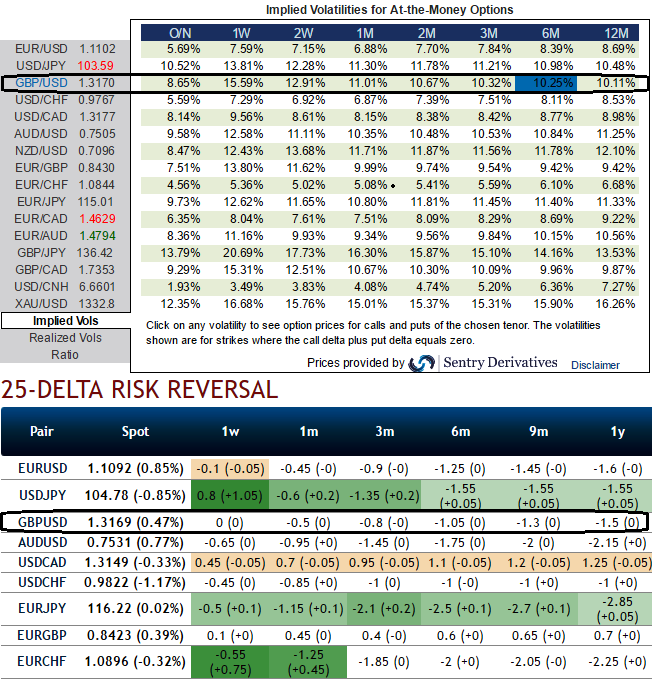

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid-April 2013.

As a result, delta risk reversal for GBPUSD has still been in negative territory suggesting bearish risks of the pair on account of either more weakness in sterling or strength in dollar.

While the UK current account balance data go back to 1946. The annual deficit (just over £100bn in 2015) didn’t get above £1bn in a single year until 1973, so we reckon the pre-1946 story can be largely ignored. Since 1946, the cumulative deficit is £881bn, and it’s getting bigger and bigger.

While ATM IVs are on higher side above 15.5% and on an average at 10.25% in longer run which is sync with increased bearish hedging sentiments, volatility shocks and the passage of time have opposite effects on the value of a vanilla option, so, advice is to buy these vols versus time.

When it can benefit from more volatility (long vega and gamma), time has a negative impact every day (short theta) in short run. This loss is the greatest when the spot is close to the option strike, and accelerates as maturity approaches (convergence towards intrinsic value, i.e. the terminal payoff). Conversely, a short volatility strategy gains value with time.

Therefore, long vol directional investors are struggling against the clock while short vol investors are not pressed by the countdown to expiry. The former ‘buy’ market volatility while the latter ‘buy’ time on the market. As a result, long vol directional investors generally are more interested in contemplating an early unwind than short vol investors.

Vega or not vega? Vega matters only if the mark to market during the lifespan of the strategy is an issue. Otherwise, volatility fluctuations can be completely ignored in the pre-exercise plan since implied volatility no longer contributes to the profit at the expiry. This can dissolve the purpose of a long vol strategy (generally more costly) if we are only interested in its final exercise.

Being long vol generally leads to more expensive strategies. This is because short vol directional strategies are cheapened via selling options or setting KO barriers.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics