Do you think the political risk into French election is priced more appropriately in bonds (but not in currencies) than going into the Brexit and the US polls?

In the remote scenario of a Le Pen Presidency with supportive government and Parliament, 10Y Bunds could approach 0bp and 10Y France-Germany 200bp, with sharply wider Bund swap spreads (54bp), FRA/OIS (20bp) and EURUSD cross currency basis (-60bp), and higher volatility (Bund implied 6bp/day).

Less extreme scenarios of Le Pen Presidency but cohabitation or extreme left Presidency will likely result in considerably less extreme outcomes.

A scenario of moderate market stress with either Le Pen or a unified left candidate achieving a 30%+ score, vs either Macron or Fillon (or the “Republicans” candidate called in replacement).

Alternative scenario: The acute market stress in a confrontation between Le Pen and a Hamon/Melenchon coalition. Regardless of the probabilities of occurrence of each scenario, we make simple arbitrary assumptions for each scenario in terms of market impact in order to rank the efficiency of vanilla EURUSD hedges.

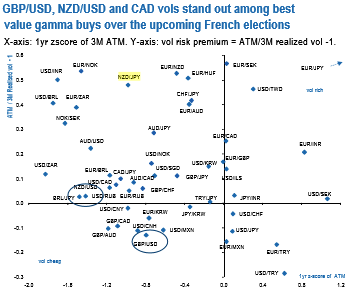

In gamma space, we find that the concentration of vol risk premia in EUR/low beta pairs leaves a number of pairs that look cheap as good value proxy hedges for a contagion stemming from above scenarios.

After all, these would have profound implications for the Brexit process at the least. Indeed, GBPUSD gamma stands out as currently cheap, along with NZDUSD and CAD crosses (refer above diagram).

USDTRY also deserves a mention as a pair where gamma has been consistently realizing, and where the 16-Apr constitutional referendum is likely to provide further support to front-end vols.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis