The sharp rebound in the ‘flash’ UK PMIs for January provided another emphatic signal that economic sentiment has rebounded post the general election, building on the evidence from other survey measures, including the CBI Industrial Trends, RICS housing and Deloitte CFO surveys. The rebound in the services reading was particularly noticeable, with the headline balance pushing up to a 16-month high of 52.9. This along with the manufacturing PMI rising to just shy of the 50 mark, contributed to the composite PMI rising to 52.4 – the highest since September 2018.

The big question is whether this is enough of a rebound to persuade the BoE to keep rates on hold at next week's meeting? Recent comments from a number of MPC members, including Governor Carney, have hinted at the prospect of more members of the Bank’s MPC joining the likes of Saunders and Haskel in voting for a near-term cut in interest rates, especially if the economy fails to show signs of a post-election bounce.

In recent weeks, the probability that markets attached to a January rate cut from the BoE had risen to as high as 70%.

However, following this morning’s data that is now back at around 50%. On balance, we remain comfortable with our view that the Bank of England will keep interest rates on hold at this juncture particularly with full details of the proposed fiscal package in the Budget on 11th March yet to be seen.

GBP headroom is capped as investors have no clarity about the most important issue that will determine the economic consequences of Brexit - the future trade deal - albeit Johnson’s WA envisages a looser set of arrangements than May’s ill-fated deal.

Moreover, there is still the risk of an economic cliff-edge at the end of 2020 if Johnson honours his commitment not to extend the one-year transition.

Our assumption is that Brexit is the dominant issue for markets and so broader economic policies will be secondary for the exchange rate. GBP will likely take its directional cue from the read-through to Brexit whereas the size of the move will be augmented or moderated by the government’s broader policy platform.

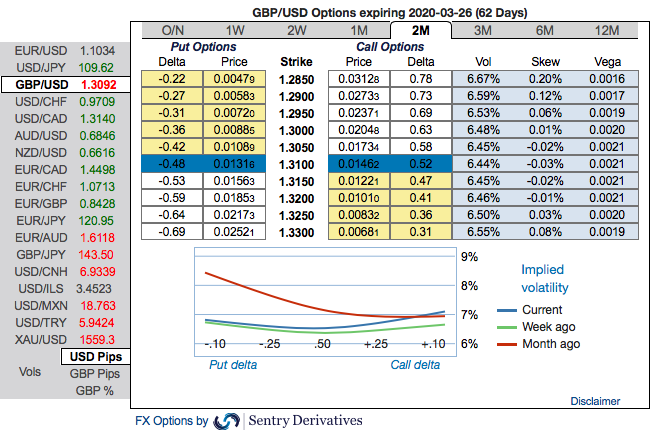

Strategy (Debit Put Spread): Contemplating above factors, wise to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/3W GBPUSD put spread (1.3515/1.29), spot reference: 1.3138 level.

The Rationale: Observe the 2m GBP skews that has stretched on both the sides, hedgers have shown interests on both OTM Calls and OTM Put options.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run amid minor bids for upside risks. Hence, we advocate the diagonal options strategy on both hedging and trading grounds. Courtesy: Lloyds & Sentry

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms