Sterling slides as fears grow of a no-deal Brexit, the September-October period will see the focus on Brexit ramped up, as we approach the latest cliff-edge date of October 31stfor the UK’s departure from the EU. With no clarity on the issue, the post-Brexit referendum lows for sterling of 93p against the euro and $1.20 versus the dollar could be tested by nervous traders, if fears continue to grow of a no-deal Brexit.

We have been recommending GBP shorts in spot expressed vs USD and JPY which have served us well thus far against this backdrop. We recommend taking profits on these trades, not because we think prospects for GBP have improved but rather because valuations on the broad index are approaching record lows.

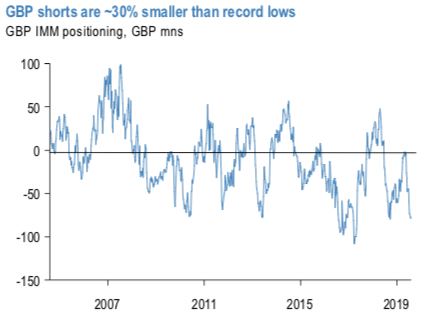

However, further weakening can certainly not be ruled out—Boris Johnson’s rhetoric is unlikely to soften in the near-term and as noted last week, investor shorts still ~30% smaller than their post-Brexit extremes (refer above chart). Hence we think it prudent to roll short GBP exposure into limited downside 30d/10d cable put spread.

In terms of various outcomes for Brexit scenarios, in our previous publications, we have conservatively put cable at 1.15 in a no-deal, but it could just as easily be another 10% lower (EURUSD is likely to be 3-5% weaker in such a scenario). Of the other scenarios, we see GBPUSD in the high 1.20s/very low 1.30s if the UK still manages to exit under the terms of the current withdrawal agreement. A general election remains a wildcard and could see GBPUSD under current levels (so sub-1.20 most likely) if the Tories are returned with a hard-Brexit mandate, or the 1.30 region if a Labour coalition is able to deliver a softish Brexit but with the offsetting risk of hard-left macro policies and the possibility of a second Scottish referendum. A second Brexit referendum would be a choice between the high teens on a second leave vote or 1.40 on a reversal to stay (we strongly reject the suggestion GBP could return to pre-referendum levels given the intervening damage done to the economy and the UK’s political credibility).

Finally, continued political paralysis and a lengthy extension to Article 50 would probably condemn GBP to drift in the mid- to low 1.20s.

Trade tips:

Book profits on GBPUSD in cash. Marked at +2.25%.

Take profits on GBPJPY in cash. Marked at +5.39%.

Initiate a 2M GBPUSD 30d/10d bear put spread on August 2nd(spot reference: 1.2152 levels). Paid 0.66%. Courtesy: JPM

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation