Trimming GBP forecasts by 2% on heightened political risk of a hard Brexit.

EU membership court ruling is scheduled to be announced on Tuesday, the United Kingdom's high court is due to announce a ruling regarding the government's ability to bypass parliament and initiate the Brexit by triggering Article 50 of Lisbon Treaty, at the Royal Courts of Justice, in London.

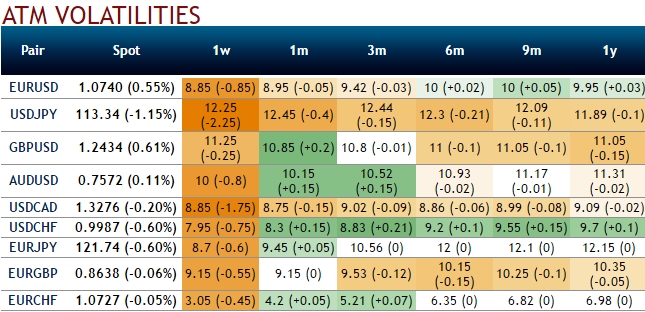

As a result, please be advised that the 25-delta risk of reversal of GBPUSD has not been indicating any dramatic shoot up nor any slumps (no fresh change in risk reversals has been observed especially in short run), but seems to be a shift in risk sentiments for condensed downside risks as we could see positive flashes in negative risk reversals.

The risk reversal curve has been traveling in a linear direction, while spot curve is slumping downwards back to converge with the RR curve.

Needless to specify as to why 1m GBP IVs have still been flying no matter what both prior and post-Brexit events, but this time these IVs are also owing to upcoming BOE’s monetary policy decision (on Feb 2nd), however, the contracts with longer tenors are normalized too, just a tad above 10%.

In the 2017 FX outlook, we articulate a modestly negative set of GBP forecasts but stressed that our conviction level in these was low and that GBP could rise or fall by 5-10% depending on the strategic objectives the government eventually set for Brexit. In other words, the forecast was a probability-weighted average of two extreme binary outcomes.

A hard Brexit that prioritizes migration and sacrifices single market access, or a soft Brexit which maintains trade ties at the expense of migration control. Europe's steadfast refusal to comprise the fundamentals freedoms of the EU appears to exclude any half-way house for Brexit -it is probable this will be an all or nothing choice.

The outlook of legal and political prospects for Brexit are still shrouded in uncertainty, hence we found it difficult to benchmark the odds on these competing scenarios, certainly to the point where we felt comfortable basing our GBP forecast on a modal view of Brexit. In the intervening two months.

However, the political risk of a hard Brexit have increased and we are lowering our forecasts accordingly, albeit the revisions are modest and we would expect to see an even weaker GBP if hard Brexit were to establish itself as the high probability modal outcome. In detail we are lowering the forecasts by around 2% -we now project EURGBP at 0.88 in Q1 and 0.93 in Q4 and cable at 1.18 and 1.24.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation