• GBP/NZD dipped on Wednesday after a survey showed a slump in UK business activity in August.

• The S&P Global/CIPS Purchasing Managers' Index (PMI) tumbled to 47.9 in August from 50.8 in July, according to a preliminary estimate, the lowest level since January 2021.

•The manufacturing PMI dropped from 45.3 to 42.5, its lowest since May 2020, while the services sector index fell from 51.5 to 48.7, matching January's two-year low.

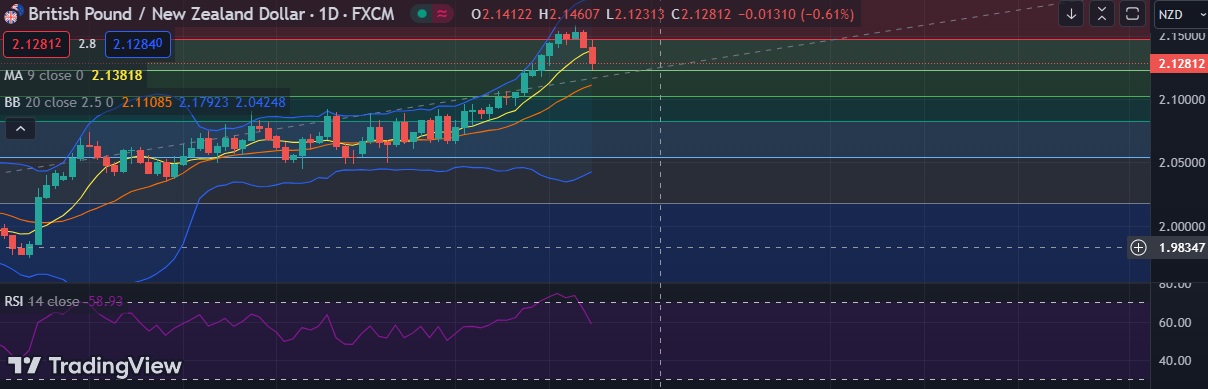

• Technicals are favouring bearish sentiment as RSI has turned lower and the pair is trading below 5 & 9-DMAs.

• Immediate resistance is located at 2.1386 (5DMA), any close above will push the pair towards 2.1486 (23.6%fib)

• Support is seen at 2.1230 (38.2% fib) and break below could take the pair towards 2.1178 (Aug 15th low).

Recommendation: Good to sell around 2.1300 with stop loss of 2.1450 and target price of 2.1150.