- GBP/NZD is extending upside after break above 5-DMA on daily charts, bias higher.

- Kiwi largely ignores improvement in milk prices at GDT auction overnight. The Global Dairy Trade Price Index gained 2.2 percent at the first auction of the year.

- Subdued dairy supply outlook as Fonterra dropped its forecast for NZ milk collection for second consecutive month weighed.

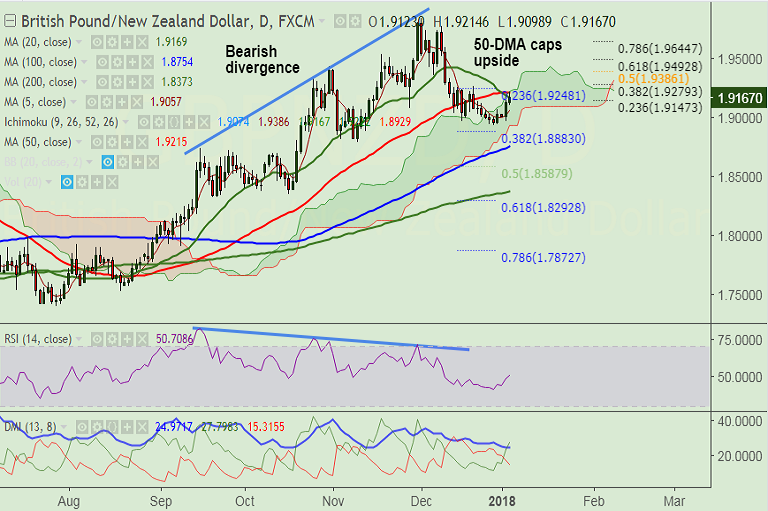

- The pair has cooled off from highs, is currently trading at 1.9175 after hitting highs of 1.9214.

- Stiff resistance seen at 50-DMA at 1.9215. Breakout could see further upside.

- Technical studies are turning slightly bullish, but bearish divergence on RSI and Stochs keeps scope for downside.

Support levels - 1.9147 (23.6% Fib retrace of 1.9838 to 1.8933 fall), 1.9058 (5-DMA), 1.8883 (38.2% Fib retrace of 1.73375 to 1.98383 rally)

Resistance levels - 1.9215 (50-DMA), 1.92488 (23.6% Fib retrace of 1.73375 to 1.98383 rally), 1.9279 (38.2% Fib retrace of 1.9838 to 1.8933 fall)

Recommendation: Good to go long on break above 50-DMA at 1.9215, SL: 1.9145, TP: 1.9250/ 1.9280/ 1.9330.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 108.887 (Bullish), while Hourly NZD Spot Index was at -30.6531 (Neutral) at 0600 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest