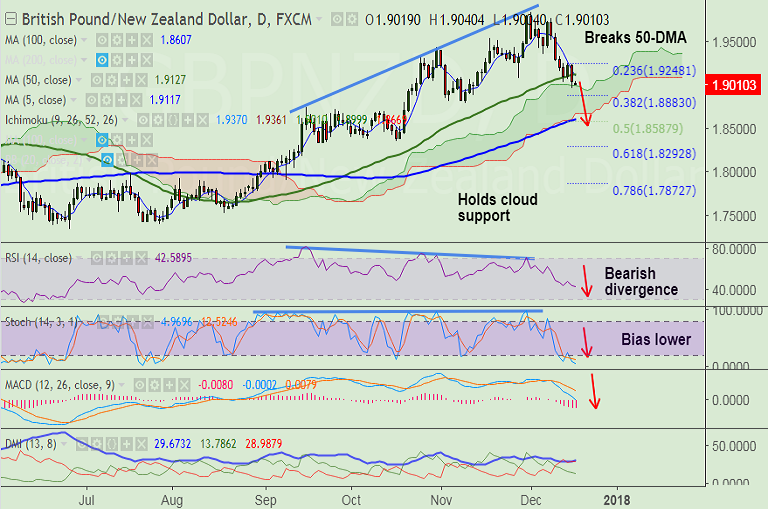

- GBP/NZD has shown a break below 50-DMA at 1.9119, bias lower.

- Pound remains weak as Brexit negotiations proceed to next stage - regarding trade and the transition period.

- The pair is trading in an extremely narrow range on the day, with the day's high at 1.9040 and low at 1.9004.

- Daily cloud offers immediate support, break below could see drag lower.

- Bearish divergence on RSI and Stochs keeps scope for downside, Technical studies are also biased lower.

- Indicators on weekly charts have turned slightly bearish. Stochs and RSI are showing a rollover from overbought levels.

Support levels - 1.8999 (cloud top), 1.8883 (38.2% Fib retrace of 1.73375 to 1.98383 rally), 1.8785 (Nov 9 lows)

Resistance levels - 1.9116 (5-DMA), 1.9127 (50-DMA), 1.92488 (23.6% Fib retrace of 1.73375 to 1.98383 rally)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-GBP-NZD-holds-50-DMA-support-at-19121-break-below-to-see-further-weakness-1060976) is progressing well.

Recommendation: Bias lower, stay short.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -106.692 (Bearish), while Hourly NZD Spot Index was at 120.853 (Bullish) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest