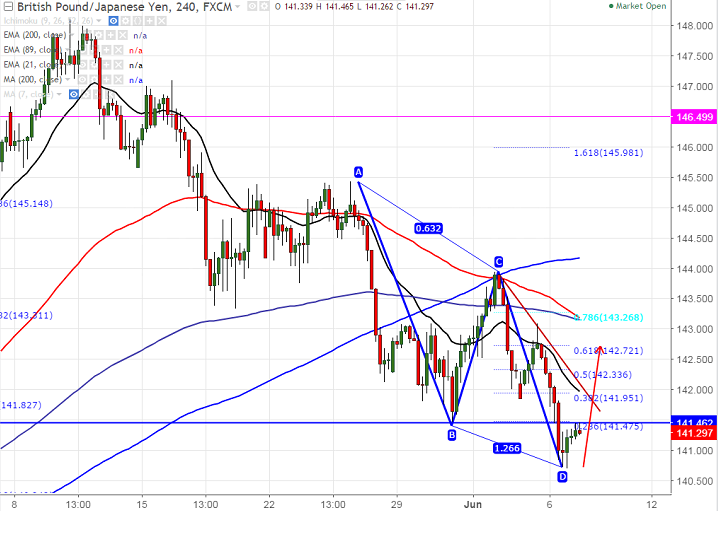

- Harmonic pattern formed – Bullish AB=CD.

- Potential Reversal Zone (PRZ) - 140.70.

- GBP/JPY has formed minor bottom around 140.70 and recovered slightly from that level. It is currently trading around 141.28.

- The pair has formed bullish AB=CD pattern in the 4 hour chart and any further bearish continuation can be seen only below 140.70.

- On the higher side, near term minor resistance is around 141.75 (4 H Tenkan-Sen) and any break above will take the pair till 142.33 (50% retracement of 143.95 and 140.71)/143.09 (Jun 5th 2017 high).

- The near term support is around 140.70 and any break below will drag the pair till 140.34 (61.8% retracement of 135.59 and 148.11)/138.50.

It is good to buy on dips around 141.20 with SL around 140.65 for the TP of 142.30/143.05.

Resistance

R1-141.75

R2 -142.30

R3- 143.05

Support

S1-141.45

S2-140.37

S3-138.50