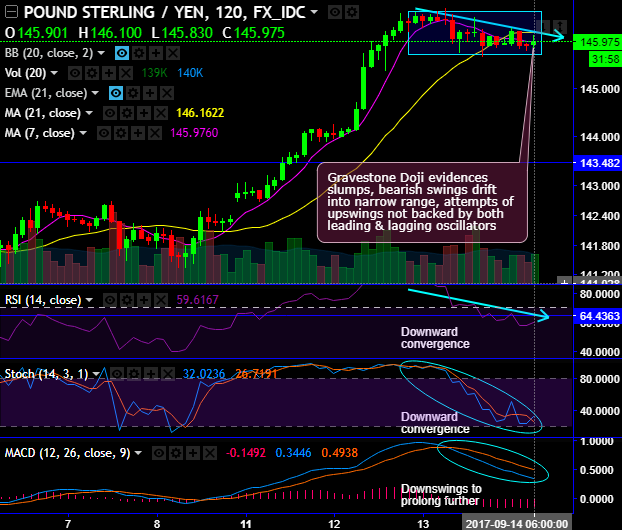

Gravestone dojis are formed at 146.416 and 146.158 levels. Ever since these bearish patterns have occurred, the previous bull trend has halted and bears manage to evidences slumps; for now, the bearish swings drift into a narrow range, attempts of upswings not backed by both leading & lagging oscillators (refer 2H chart). Instead, more dips are foreseen on bearish DMA crossover

Although GBPJPY halted bull swings in the recent times at 146.664 levels, the counter rallies are evidenced every now and then to signify the consolidation phase in the major trend (refer monthly chart), the upswings on this time frame are heading towards the stiff resistance at 147.657 levels despite last two months’ price slumps, the rallies are likely to extend further upon confirmation from both leading & lagging indicators.

The stochastic oscillator is approaching overbought trajectory but no traces of bearish crossover which means ongoing bullish sentiments are likely to continue but with a pinch of salt. While historically, RSI has shown faded strength in rallies at 58 levels but the leading indicator has also entered into overbought zone.

Buying momentum is intensified on this timeframe as well as the leading oscillators are converging upwards.

MACD, on the other hand, signals indecisiveness on monthly terms but signaled the extension of the bullish trend.

Well on a broader perspective, shooting star at 144.328 levels on monthly plotting restrain rallies below 7EMAs, Shooting star on rallies resumes major downtrend, but bullish engulfing counters to break above 23.6% Fibonacci retracement levels, consequently, we foresee more rallies upto 150 levels (i.e. 21EMA & 38.2% Fibos).

Overall, the minor trend has little edgy, while the major trend has been robust for the consolidation phase. Thus, we advocate tunnels spreads on speculative grounds and adding longs in futures contracts of mid-month tenors in order to arrest upside risks.

Currency Strength Index: Ahead of BoE’s monetary policies, FxWirePro's hourly GBP spot index is flashing at 97 levels (highly bullish), while hourly JPY spot index was at shy above -104 (highly bearish) at 07:50 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings