Yesterday, the Bank of Japan has maintained the status quo, negative rates are kept on hold. The BoJ cuts their GDP projections from 0.9% to 0.6%, which is no surprise considering what looks like a weak Q1. In addition, FY2019 and 2020 GDP and inflation forecasts have been cut slightly. Particularly interesting is the new inflation outlook, which now includes FY2021. BoJ (Bank of England) expects CPI inflation to hit 1.6% by then (lowest t+2 inflation forecast since 2013). That is, the BoJ does not expect to meet its inflation mandate within a two to three-year horizon.

BoE is scheduled for their monetary policy for next week. Ongoing political uncertainty indicates a continuation of the ‘wait-and-see’ message regarding the timing of the next bank rate hike.

Still, an expected upgrade to GDP growth in 2019 and the persistence of above-target inflation over the forecast horizon will do little to endorse the current ‘dovish’ market view on UK bank rate.

The urgency to hike anytime soon, however, is likely to be little changed, particularly with the outlook still clouded by the Brexit fog.

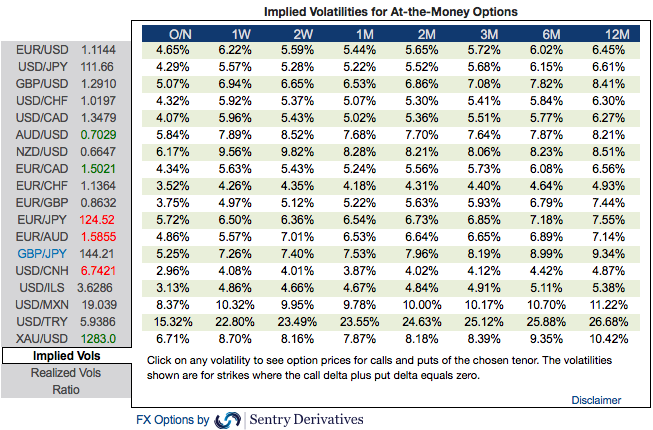

OTC outlook and Hedging Strategy: Please be noted that IVs of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 140 levels (refer above nutshells evidencing IV skews).

Accordingly, put ratio back spreads (PRBS)are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 144.21 levels).

The rationale for PRBS: Well, the traders tend to perceive these trades as a bear strategy, because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options, and one that makes a lot of sense.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns. In most long/short spreads, you make money if the stock moves, but you lose if it remains in the middle “loss zone.” A ratio put back spread is different because it creates a net credit, so even if the underlying spot FX price does not move very much, you keep the credit if all of the puts expire worthless.

Every underlying move towards the ITM territory increases the Vega, Gamma, and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix & Lloyds

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -17 (which is mildly bearish), while hourly JPY spot index was at 87 (bullish) while articulating (at 07:47 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand