Chart - Courtesy Trading View

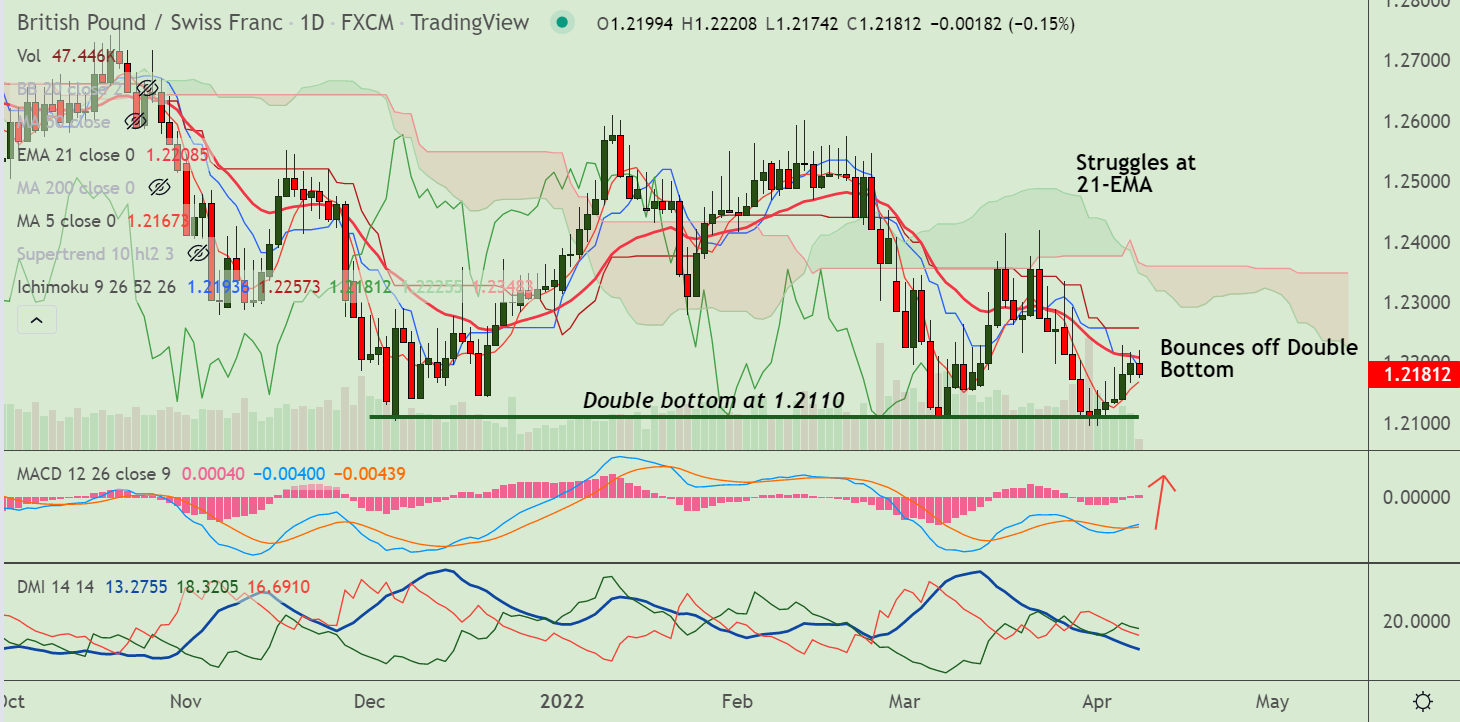

GBP/CHF was trading 0.14% lower on the day at 1.2184 at around 07:45 GMT.

The pair has snapped a 5-day bullish streak at 21-EMA resistance, break above required for upside continuation.

Price action is extending sideways, holds above 200H MA support, retrace below could see some weakness.

Technical indicators support upside in the pair. MACD shows bullish crossover on signal line.

Stochs are on verge of bullish rollover from oversold levels, 5-DMA is sharply higher.

GMMA indicator shows major trend in the pair is lower. Rejection at 21-EMA will see downside resumption.