GBP/CHF chart - Trading View

GBP/CHF was trading largely rangebound at 1.2404 at around 06:00 GMT, traders await UK inflation data for fresh impetus.

UK Consumer Price Index (CPI) for January month is due later on Wednesday at 07:00 GMT. Headline CPI inflation is expected to ease from 0.6% prior to 0.5% on an annual basis.

Core CPI (excluding volatile food and energy items) is forecasted to print at 1.3% YoY versus 1.4% in the previous readouts.

Support levels - 1.2363 (5-DMA), 1.2289 (110W EMA), 1.2272 (21-EMA)

Resistance levels - 1.2471 (61.8% Fib), 1.25 (psychological mark), 1.2603 (200W MA)

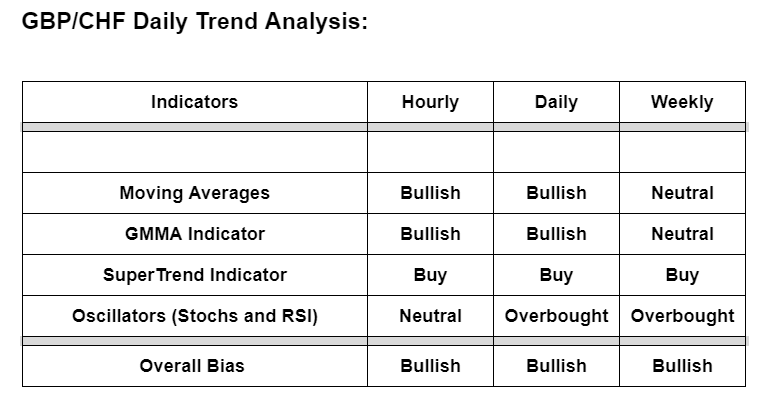

Summary: Technical bias as indicated in the 'Daily Trend Analysis' is strongly bullish. The pair is extending break above 110W EMA and is on track to test 61.8% Fib retracement at 1.2471.