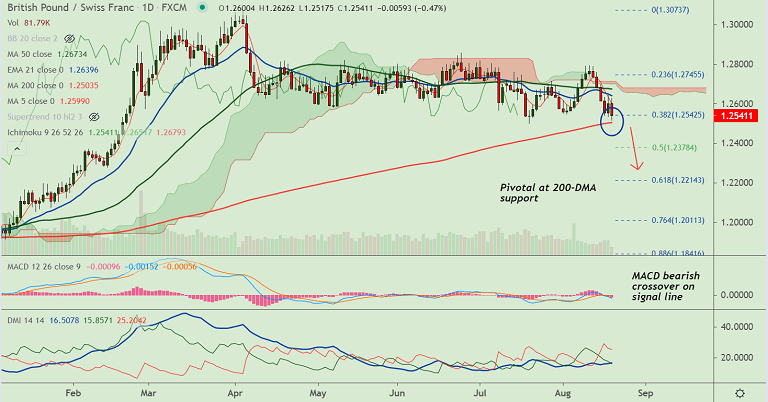

GBP/CHF chart - Trading View

Technical Analysis: Bias Bearish

- Price action is below cloud and is just shy of 200-DMA support

- GMMA indicator is showing a bearish shift in the near-term trend

- Momentum indicators are strongly bearish, Stochs and RSI are sharply lower

- Volatility is high and rising as evidenced by widening Bollinger bands

- MACD is below zero and a bearish MACD line crossover on signal line adds to the downside bias

Support levels - 1.2503 (200-DMA), 1.2467 (55-EMA), 1.2378 (50% Fib)

Resistance levels - 1.2598 (5-DMA), 1.2630 (110-EMA), 1.2661 (55-EMA)

Summary: GBP/CHF trades with a bearish bias. Price action is pivotal at 200-DMA support. Break below will see dip till 50% Fib at 1.2378. Bearish invalidation only above daily cloud.