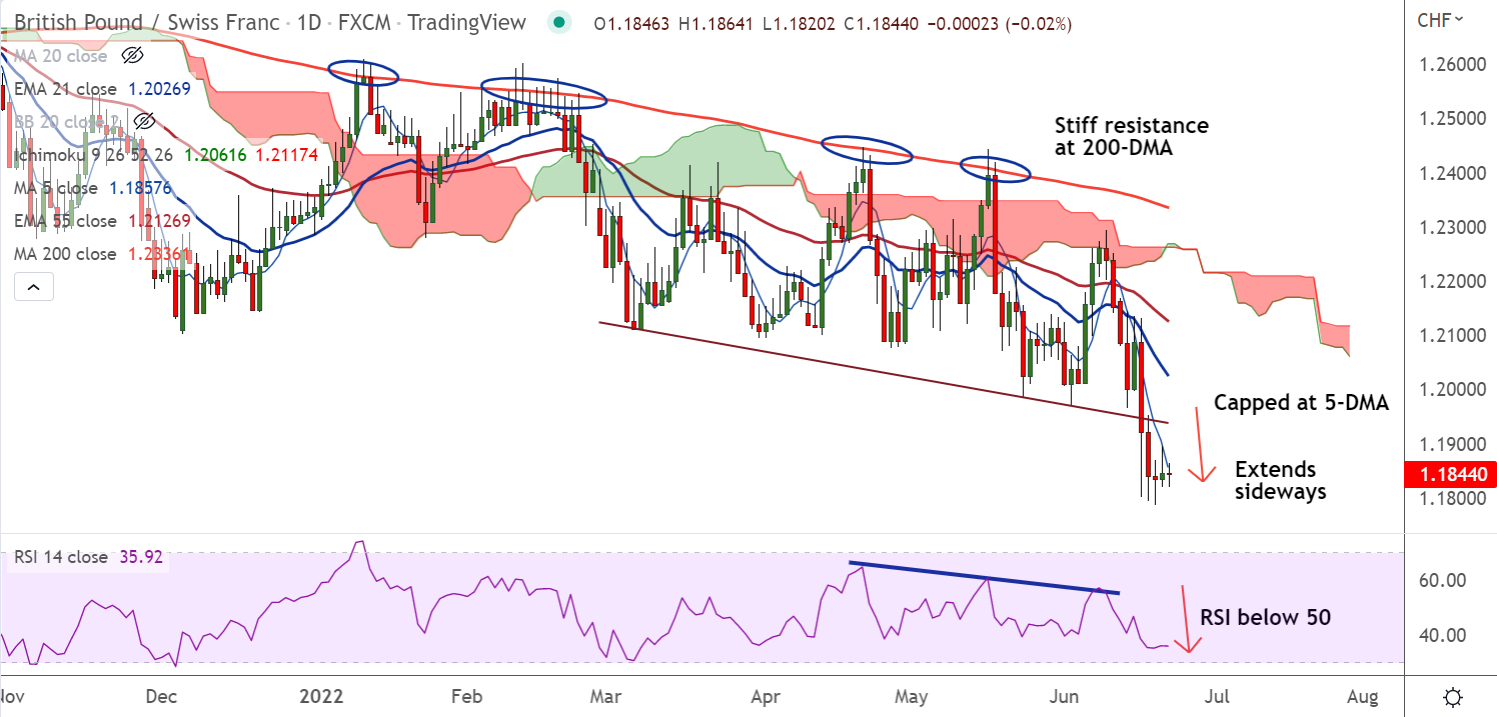

Chart - Courtesy Trading View

GBP/CHF was trading in a narrow range with session high at 1.1864 and low at 1.1820.

The British pound remains muted as traders remain cautious ahead of UK inflation report, due early on Wednesday at 06:00 GMT.

The annual UK Inflation is likely to refresh the four-decade high at 9.1% vs. 9% reported earlier. While the Core CPI is expected to slip to 6% against the prior print of 6.2%.

On a monthly basis, the CPI could fall significantly to 0.6% versus 2.5% prior.

PPI Core Output YoY is expected to rise from 13% to 13.7% on a non-seasonally adjusted basis whereas the monthly prints may increase to 2% versus 1.6% prior.

The Retail Price Index (RPI) is expected to rise to 11.4% YoY from 11.1% prior while the MoM prints could hit to 0.5% from 3.4% in previous readings.

A higher inflation rate will further dampen the UK economic data and henceforth will restrict the BOE to dictate higher interest rate hikes.

Technical indicators support downside in the pair. Immediate resistance is seen at 5-DMA, break above could see some upside.