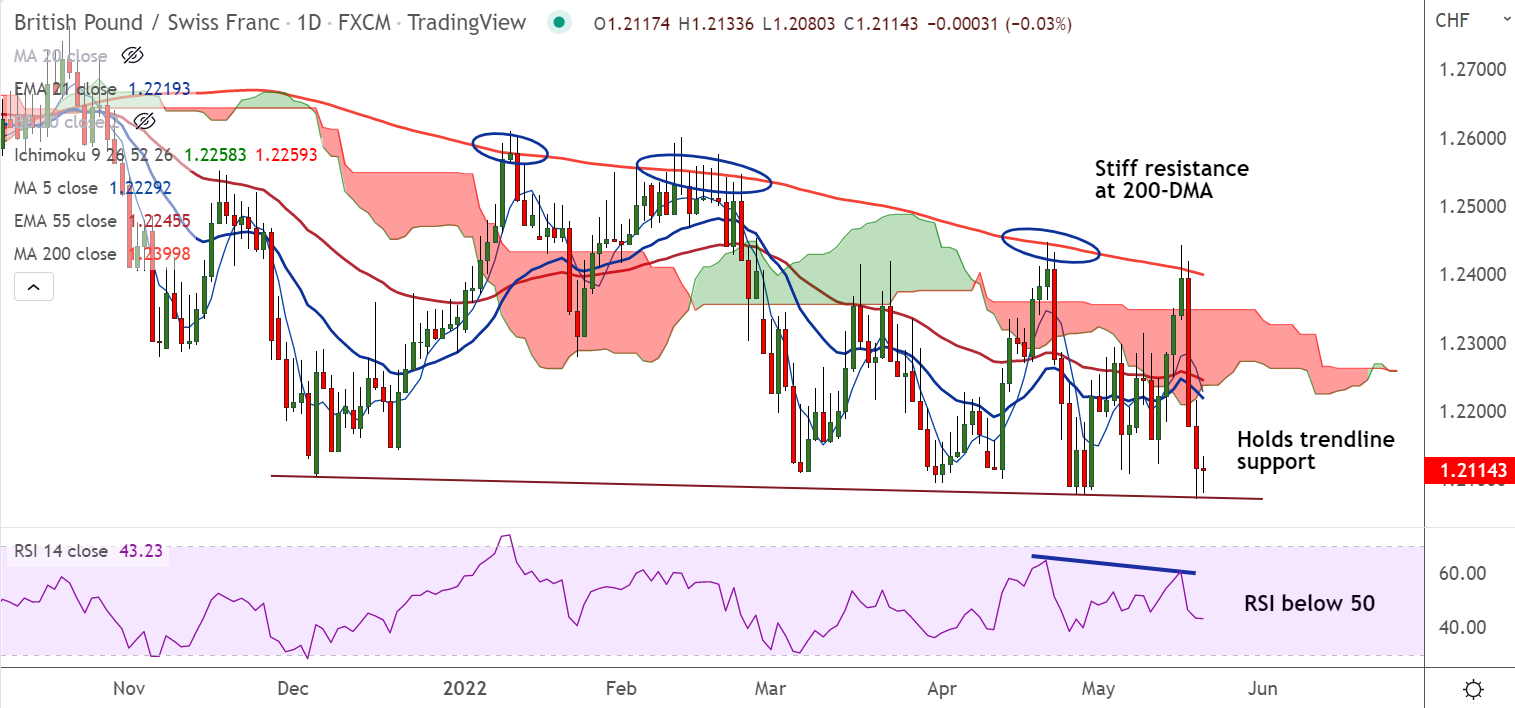

Chart - Courtesy Trading View

GBP/CHF was trading 0.04% higher on the day at 1.2121 at around 06:40 GMT, up from session lows at 1.2080.

The pair showed a rebound from lows after a lower-than-expected plunge in UK Retail Sales earlier today.

UK’S Office for National Statistics has reported the annualized Retail Sales at -4.9%, better than -7.2% expected, but explosively lower than the prior positive release of 0.9%.

Further, core Retail Sales landed at -6.1%, less negative than the estimates of -8.45 and the previous release of -0.6%.

Technical indicators support downside in the pair. Upticks can be used for entry opportunities.

Watch out for break below major trendline support at 1.2075 for further downside. Bearish invalidation only above 200-DMA.