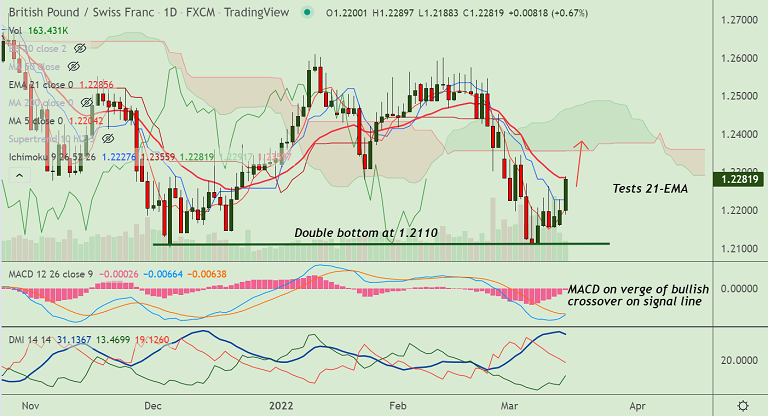

Chart - Courtesy Trading View

GBP/CHF was trading 0.64% higher on the day at 1.2279 at around 13:40 GMT, bias bullish.

The pair has bounced off 'Double Bottom' at 1.2110, scope for further upside on break above 21-EMA.

Data published by the Office for National Statistics (ONS) on Tuesday showed UK’s official jobless rate arrived at 3.9% in January vs. the previous 4.1% and 4.0% expected.

The claimant count change showed a bigger than previous drop last month. Number of people claiming jobless benefits fell by 48.1K in February from-31.9K booked previously. The claimant count rate came in at 4.4% last month vs. 4.6% prior.

The UK’s average weekly earnings, excluding bonuses, arrived at 3.8% 3Mo/YoY in January versus +3.7% last and +3.7% expected. The gauge including bonuses came in at 4.8% 3Mo/YoY in January versus +4.3% previous and +4.6% expected.

On the other side, prospects of a positive outcome in Ukraine-Russia peace talks eased markets concerns and dented demand for the safe haven Franc.

GBP/CHF trades with a bullish bias. Chikou span is biased higher. MACD is on verge of bullish crossover on signal line.

5-DMA has turned north and price action is now above 200H MA. Break above 21-EMA will fuel further upside in the pair.