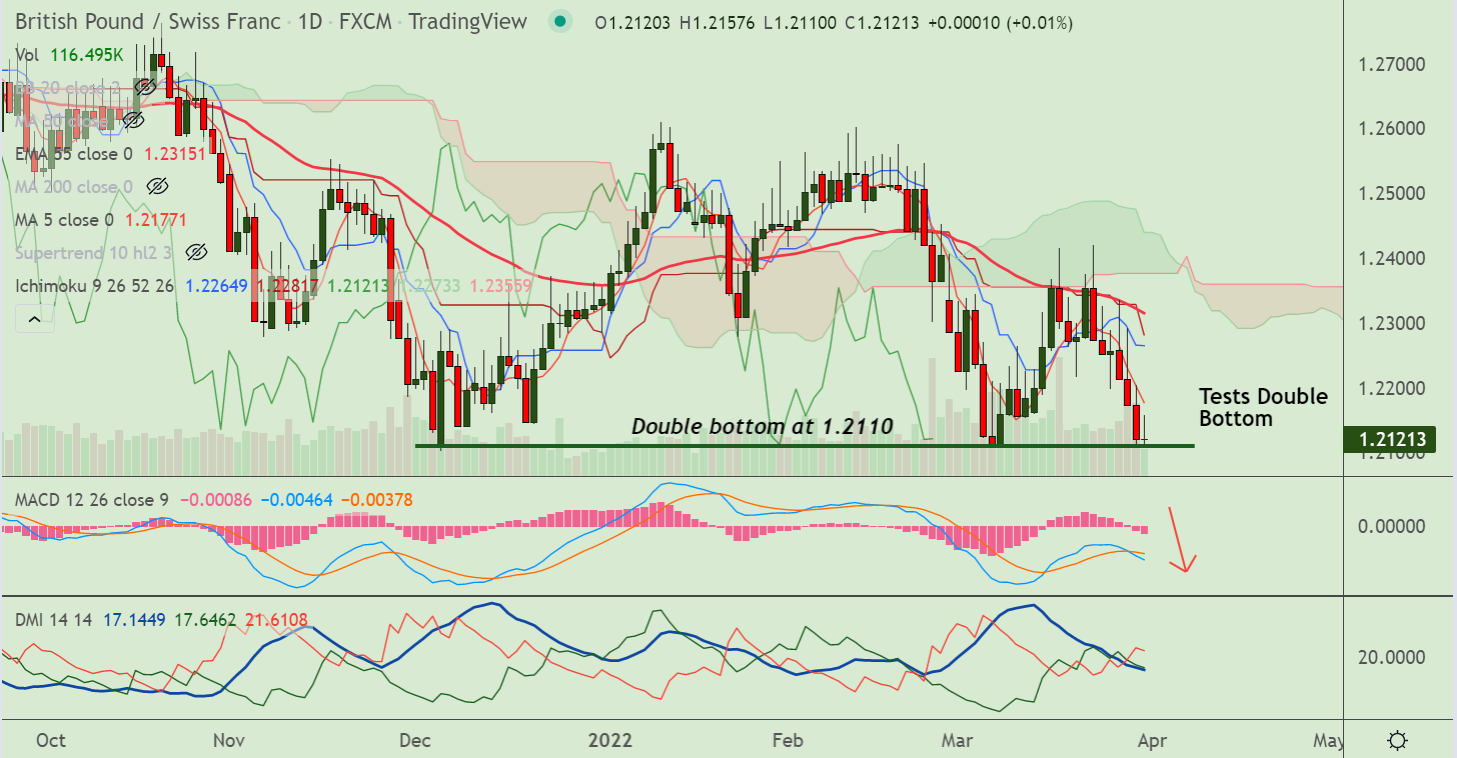

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- GBP/CHF was trading 0.03% higher on the day at 1.2124 at around 10:00 GMT

- The pair has erased early gains, slipped lower from session highs at 1.2157

- Major moving averages are trending lower, price action is below major moving averages

- MACD confirms bearish crossover on signal line, ADX supports weakness

- Bearish 5-DMA crossover on 20-DMA adds to the bearish bias

- Momentum is bearish, volatility is high, Chikou span is biased lower

Support levels - 1.2110 (Double Bottom), 1.2072 (Lower BB)

Resistance levels - 1.2178 (5-DMA), 1.2218 (20-DMA)

Summary: GBP/CHF poised for further downside. Watch out for break below Double Bottom at 1.2110 for downside continuation.