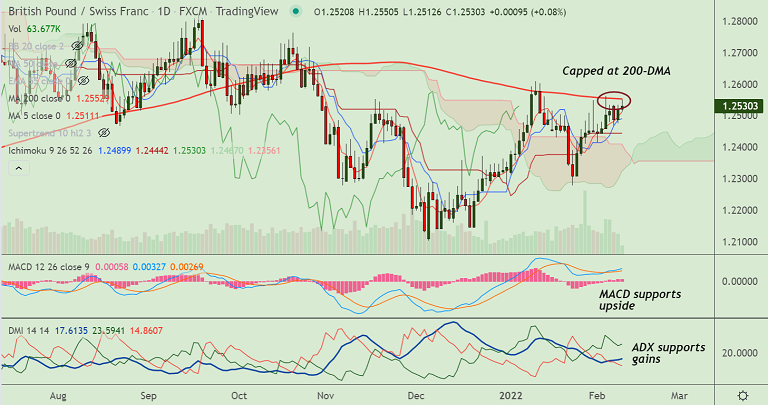

Chart - Courtesy Trading View

Technical Analysis: Bias Bullish

- GBP/CHF was trading 0.10% higher on the day at 1.2533 at around 11:30 GMT

- The pair finds stiff resistance at 1.2550 (converged 200-DMA and trendline)

- MACD supports upside in the pair, ADX shows further upside potential

- Momentum is bullish, Stochs and RSI are sharply higher, RSI is above 60

Support levels - 1.2513 (5-DMA), 1.2458 (21-EMA), 1.2424 (55-EMA)

Resistance levels - 1.2550 (converged 200-DMA and trendline), 1.2563 (Feb 3 high), 1.2609 (Yearly high)

Summary: GBP/CHF pivotal at stiff resistance at 1.2550. Technical bias is bullish. Watchout for decisive break above 1.2550 for further upside.