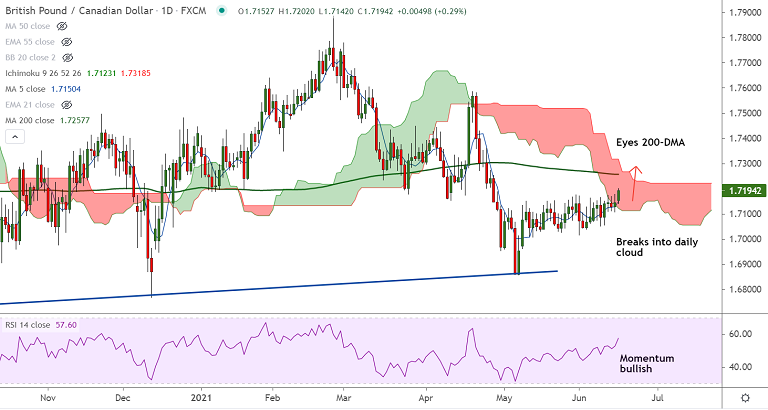

GBP/CAD chart - Trading View

GBP/CAD was trading 0.29% higher on the day at 1.7194 at around 11:40 GMT.

The pair spiked higher on the day after strong UK CPI stoked chances of a BOE rate hike and boosted the pound.

Data released earlier today showed UK Consumer Prices Index (CPI) 12-month rate came in at +2.1% in May, beating estimates at +1.8% and compared to +1.5% in April.

Meanwhile, the core CPI rose by 2.0% YoY last month versus +1.5% registered in April, matching the consensus forecast of +1.5%.

The monthly figures showed that the UK consumer prices arrived at +0.6% in May vs. +0.3% expectations and +0.6% prior.

On the other side, markets look forward to Canadian consumer inflation figures for further impetus.

The pair has retraced into daily cloud and is extending breakout above 200-week MA. Bullish momentum and high volatility to drive further gains.

GMMA indicator also shows major and minor trend are strongly bullish. Scope for test of 110-EMA ahead of 200-DMA.