The PMI in the UK has provided a first taster. The coming week’s UK PMI data (Tue-Thu) and BoE credit data (Wed) will provide further color on Q4 trends. Survey data for December so far – including GfK consumer confidence and our own Business Barometer – have seen improvements relative to November, but sharp movements in surveys since the referendum have generally tended to have little carryover to official estimates of ‘hard’ activity.

While Australia is scheduled to announce its trade balance numbers on Thursday, Australia's trade deficit was increased by 21 pct to AUD 1.54 billion in October 2016 from an upwardly revised AUD 1.27 billion in September. The figure came in below market expectations of AUD 0.80 billion gap, as exports rose 1.0 pct to AUD 27.63 billion while imports went up at a faster 2.0 pct to AUD 29.17 billion.

In the prevailing puzzled environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7769 levels, currently trading in sideways to signal some bearish pressures. Consequently, we advocate below hedging strategy with cost effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

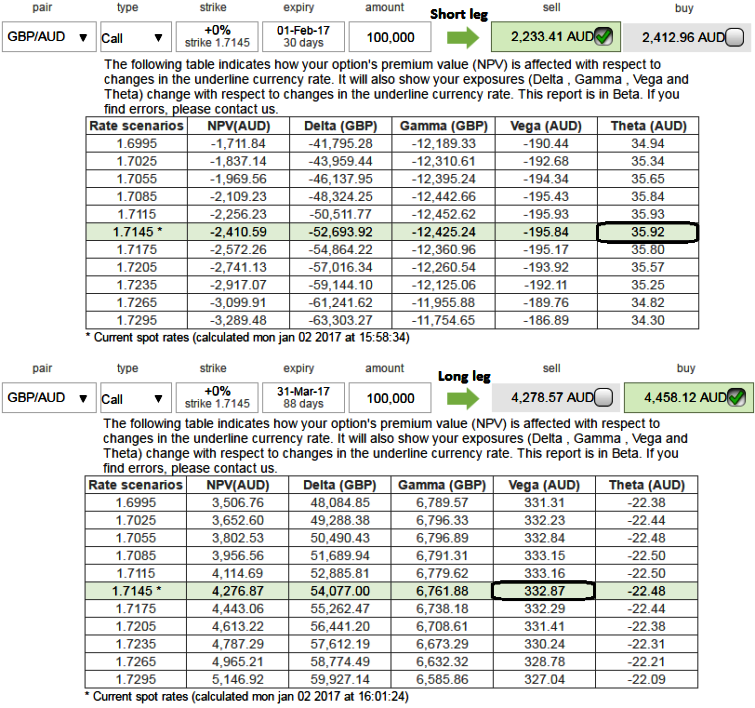

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 3M at the money vega put, long 3M at the money vega call and simultaneously, Short theta in 1m (1.5%) out of the money call with positive theta or closer to zero. Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: As you could observe the vega of long leg (buy) call option position is 332.87 USD and it implies that if IV increases or decreases by 1%, the option’s premium would have an impact in an increase or decrease by 332.87 USD, respectively. The Vega of a short (sell) option position is negative and an increasing IV is bad.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data